Core real estate fund performance continues to slow amid negative net flows

The National Council of Real Estate Investment Fiduciaries has released first quarter 2017 results for the NCREIF Fund Index – Open‐end Diversified Core Equity. The NFI-ODCE consists of 24 funds, totaling $220.3 billion of gross real estate assets and $176.2 billion of net real estate assets.

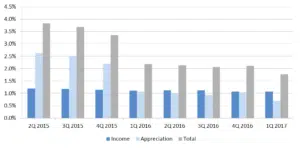

Quarterly total NFI-ODCE returns gross of fees slipped below 2 percent in the first quarter 2017, at 1.77 percent, marking the lowest quarterly return since 0.75 percent in the first quarter 2010. The income return was unchanged from the prior quarter, at 1.07 percent, although it was down marginally from 1.11 percent in the first quarter 2016. Quarterly appreciation continued to moderate in the first quarter, falling to 0.71 percent from 1.04 percent in the fourth quarter 2016 and 1.07 percent a year ago.

Quarterly NFI-ODCE Gross Return Trends

The annual NFI-ODCE total return gross of fees was 8.34 percent, down from 13.67 percent for the year ending first quarter 2016 and below the annualized since inception return of 8.74 percent. The annual total return was comprised of a 4.45 percent income return and 3.75 percent appreciation.

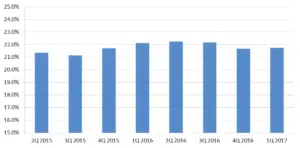

NFI-ODCE returns measure fund-level performance and therefore can reflect other investments beyond properties, including cash balances and leverage. Leverage is conservative among these funds given their core strategies, ranging from 15 percent to 34 percent over the quarterly series history beginning in 2000. NFI-ODCE leverage was unchanged over the quarter, at 21.7 percent.

NFI-ODCE Leverage Trends (% of total assets)

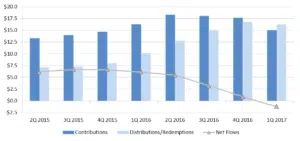

Quarterly net NFI-ODCE fund flows were negative for the second consecutive quarter, driving the annual trend into negative territory as well. First quarter 2017 net flows of negative $738.1 million reflected $2.7 billion in contributions and $3.5 billion in distributions/redemptions. Quarterly distributions/redemptions have been in the $3.5 billion to $4.5 billion range for five quarters, while contributions had not been below $3.0 billion since fourth quarter 2014. On an annual basis, net flows totaled negative $1.2 billion on contributions of $15.0 billion and distributions/redemptions of $16.2 billion.

NFI-ODCE Fund Flow Trends (4Q Rolling Total, Billions)

Additional details from the NFI-ODCE release are in the attached Snapshot Report.