To read this full article you need to be subscribed to Institutional Real Estate Americas

REITs may provide insights into private real estate pricing

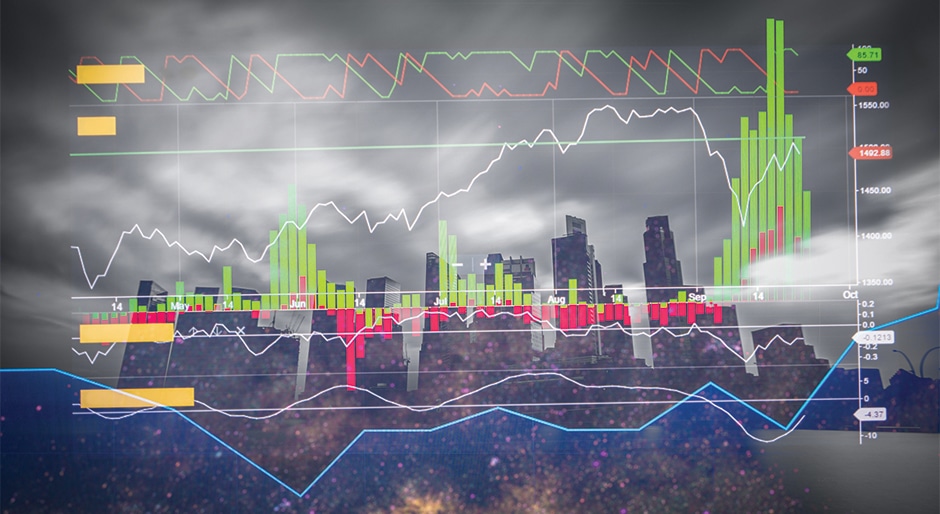

Listed real estate stock prices are changing moment by moment, reflecting investors’ perceptions of the value of public real estate companies and updating constantly as new information is absorbed by the market. This leads to much higher pricing volatility than private real estate, and perhaps a tendency to overreact on both the upside and the downside. But this also means listed real estate stocks can be a leading indicator for private real estate values, as private market transactions are slower and private market index information is at least a quarter out of date when published.

“The REIT market is increasingly a leading indicator,” explains Scott Crowe, chief investment strategist at CenterSquare Investment Management. The firm, which has been tracking implied cap rate changes in the REIT market since 1995, has begun publishing the data in a new analysis, The REIT Cap Rate Perspective, available upon request.

“Often what the REIT market is worried