Potential to capitalise: Shanghai’s urban regeneration plans hold promise for repositioning assets

Pamfleet began exploring the possibility of investing in Shanghai in 2014, with the intention of deploying a bottom-up approach of buying older, underperforming properties for repositioning. The firm spent two years determining how to source, structure and finance deals before it closed its first acquisition. Five years on, with value-added projects completed, many lessons have been learnt, some of which are shared in this article.

The investment market

Shanghai has an active investment market, with many whole-building transactions each year. Brokers are understandably keen to steer buyers towards the deals that are easiest to close, which often results in foreign investors trading amongst themselves. In 2018, Savills found foreign buyers spent 54.5 billion yuan (US$7.8 billion) in Shanghai, representing 55 percent of the total transaction volume. Tighter credit conditions, the impact of the trade war, and an impending oversupply in some sectors have driven down investment transaction volumes in the past two years. According to Cushman & Wakefield, five deals of greater than 3 billion yuan (US$428 million) closed in 2017, but only two in 2018. In the 1 billion to 3 billion yuan (US$143 million to US$428 million) price range, the figures were 31 and 25, respectively. For deals of less than 1 billion yuan (US$143 million), 78 transactions completed in 2017 and 67 in 2018. Despite the difficult macro conditions, opportunities exist for value-added investors willing to roll up their sleeves. Many small- to medium-size deals are not widely marketed, however, and it takes time and perseverance to exploit these opportunities.

Several holding structures for investments exist in China — asset purchase, onshore or offshore equity transfer, and pre-2006 grandfathered foreign-company direct ownership. Each has different implications for transaction timelines, approvals, taxes (capital and income) and financing options — onshore or offshore. Critically, it is important to be aware of the remaining land tenure, which in some cases may be rather short. An established procedure for renewal does not exist, and although a recent case saw the land tenure for an uncompleted retail project renewed from 21 years to 40 years with the payment of a premium, it cannot be taken as a precedent.

Planning and urban regeneration

The Shanghai Master Plan 2017–2035 sets out goals for Shanghai to become a paradigm of sustainable development for high-density mega-cities. Construction land boundaries, population-size ceilings, ecological environment boundaries and city safety are the four overriding criteria. After decades of development, the focus for the core Central Activity Zone has switched to organic urban renewal and nonexpansionary planning.

City authorities define how areas are to be regenerated and redeveloped through master planning and project permissions, and they undertake some works directly. Private owners are encouraged to work with the districts as part of their urban-regeneration mandate, and it is essential to work with government agencies and the local community.

Case study 1: Changning District

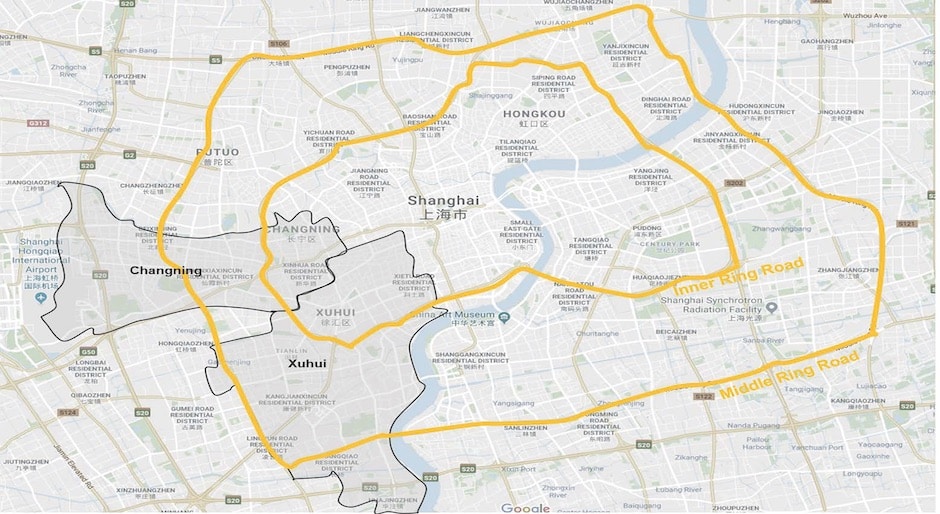

Changning covers 38 square kilometres in the western part of the city centre and is renowned for its green environment and quality of life. Nevertheless, development has been rapid. Six metro lines now serve the district, and the Shanghai Hongqiao International Airport and Hongqiao high-speed railway station combine as one of the largest transport hubs in China. Shanghai’s 13th Five-Year Plan stipulates further expansion of Hongqiao to establish Western Changning as an international trading and financial centre.

The Inner Ring and Middle Ring roads divide Changning into three major areas. Eastern area, within the Inner Ring Road, forms part of the Central Activity Zone and has more than 400 listed heritage buildings, with a combined floor area of 500,000 square metres, mostly located along Yuyuan, Wuyi and Xinhua roads. Eastern Changning’s urban renewal has three strategic focuses: protection and utilisation of historical landscapes, enhancement of the cultural environment, and ecological remediation. Regeneration began in 2014 on Yuyuan Road, which lies between Jing’an Temple and Central Park. In five years, more than 30 building frontages have been revitalised through collaboration amongst government, state-owned enterprises and the private sector. Take a creative business park located at 1107 Yuyuan Road as an example: The forecourt was originally a parking lot before the owner opened the walls and transformed it into a lawn, which has since become a popular location for concerts. The street is now full of bookstores, coffee shops, dining in heritage houses, fashion studios, and galleries.

The transformation of Yuyuan Road serves as a model in Eastern Changning to upgrade existing space rather than demolish and rebuild, and Wuyi Road was identified as the second street to be revitalised. Only two kilometres from Shanghai’s most important central business district, Nanjing Road West, the street is named after the Wuyi Mountains in Fujian Province and is rich in history. Lying at the centre of the former International Settlement, its cultural vibrancy and uniqueness are seen in its European villas, Shikumen homes, and the large, lush phoenix trees lining both sides of the street.

The district government began Wuyi’s renewal project in 2017. Serving as an archetype for Shanghai’s fusion of historic architecture and modern living standards, the street is being upgraded into a hub for dining, leisure, entertainment and art. The project will refurbish 34 rare buildings and turn them into public art galleries, cafes, teahouses and restaurants. Residents will be able to walk down ancient alleyways and see garden houses restored to immaculate condition, and they’ll be able to converge in one of the many public spaces, including a cultural centre housed in a former gramophone record factory. Earlier this year, the factory was tendered by the district government and acquired by a well-known Hong Kong developer, who will refurbish two listed villas, build 12,000 square metres for the arts and creative industry, and provide 1,000 square metres of landscaped community activity space. Along the street front, the district authority has been demolishing illegal construction; burying overhead cables; replacing street furniture; and encouraging landlords to renovate and bring in better-quality tenants, such as jewellery shops, coffeehouses and snack shops with a local history.

105 Wuyi Road

Standing at 105 Wuyi Road, adjacent to a famous historic villa that is occupied as the Consulate General of Belgium, is a four-storey residential property built in 1993 for Chinese nationals visiting from living abroad. In 2017, the owners decided to sell it, as the younger generations were no longer living in Shanghai. Although the building had no architectural merit, Pamfleet saw an opportunity to reposition it as modern residences behind a facade that would be subtly redesigned to pay homage to the neighbourhood’s heritage.

The layout was remodelled to provide eight apartments with 2.5 bedrooms each placed around a large living/dining area. The old building was taken back to its structure, the main power supply upgraded, and new services and finishes installed. Newly opened balconies and enlarged double-glazed windows now bring in natural light and green views. And underfloor heating and central air conditioning further enhance the building. The apartments are about 110 square metres, and two units on the ground floor have small private gardens.

At acquisition, an investment holding structure of eight wholly foreign-owned enterprises (WFOEs) was established. This enables a disposal strategy of selling individual apartments by way of equity transfer of each WFOE, which should be attractive to buyers from outside Shanghai.

Case study 2: Xuhui District

Xuhui District is in the southwestern part of Shanghai’s city centre, facing Pudong across the river and bordered to the north by Huangpu, Jing’an and Changning Districts. Xuhui covers 55 square kilometres, and measures approximately seven kilometres east to west and 13 kilometres north to south. Six metro lines serve the district. Northern Xuhui lies within the Inner Ring Road and, like Eastern Changning, forms part of Shanghai’s Central Activity Zone — traditionally the hotspot for foreign direct investment. But it is the area farther south, down the western bank of the Huangpu River towards the Middle Ring Road, that has seen the greatest effects of dynamic urban planning in the past five years. One of the drivers of growth in this corridor has been massive, decentralised new development on the opposite, Pudong, side of the river.

Following the Shanghai EXPO in 2010 and the announcement in 2012 that Qiantan would be positioned as a municipal-level CBD, proactive town planning encouraged prolific development in Pudong, especially to the south of the exposition site. With many bridges and tunnels linking the two sides, the Xuhui district government has capitalised on the connectivity by repositioning and upgrading its riverside stretch. This area, now named West Bund, has established itself as a cultural and creative zone with museums, galleries, a media park and a life sciences park, along with several large-scale residential developments. With media industry leaders such as Dreamworks Studios moving in, the West Bund has hosted international exhibitions and shows, and has rapidly become an artistic and creative nexus.

Cohost West Bund

In 2016, Pamfleet acquired an underperforming hotel in Xuhui, immediately within the Middle Ring Road. Built in 2004 on the tree-lined Baise Road next to the Shanghai Botanical Garden, the 7,319-square-metre, four-storey property was struggling as a hotel; however, it presented great potential to capitalise on increasing rental demand for multifamily residences in this up-and-coming location. Together with its partners, Pamfleet repositioned the property with a change of use to a design-led, 66-unit apartment building with spacious communal co-living facilities, plus a swimming pool, gym and tennis court. The extensive renovation was completed in 2018, and the property is now branded and operating as Cohost West Bund. The retail units are fully let, and the residential units, ranging from 33-square-metre studios to 127-square-metre duplex lofts, are achieving high occupancy.

Repositioned thinking

Looking ahead, there should be many opportunities to deploy a value-added strategy of revitalising existing buildings, as Shanghai continues to move from years of unbridled development towards a more organic, sustainable model of urban regeneration.

Andrew Moore is CEO, Kelvin Wong is managing director and Qiao Yu is general manager of Pamfleet. Moore and Wong are based in Hong Kong, and Yu is based in Shanghai.