To read this full article you need to be subscribed to Institutional Real Estate Asia Pacific

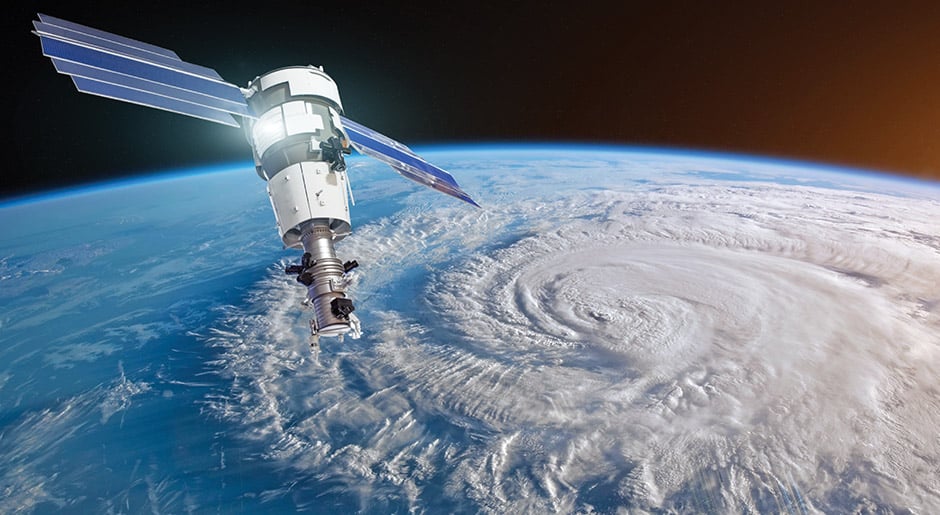

The megastorm era: Why the real estate industry is dragging its heels on pricing weather risk into values and investment assumptions, and what can be done about it

At one point this past September, the heavens became hell on earth.

Hurricane Florence (pictured) roared ashore in the Carolinas with an unprecedented storm surge of 4.0 metres (13.1 feet), then stalled, drenching the Eastern Seaboard of the United States with record, catastrophic rain of almost 90 centimetres (35.5 inches).

At the same time, on the other side of the world, Super Typhoon Mangkhut hit Hong Kong with the greatest force on record, a banshee scream with gusts of 250 kmh (155 mph), with 60,000 felled trees reported.

Storms Barijat, Olivia, Isaac, Helene and Joyce joined the tropical-cyclone party, too, at the same time. The seven major storms developed separately, causing havoc for the Leizhou Peninsula in Guangdong, China; Hawaii; the Antilles in the Caribbean; and anyone stuck out in the north Atlantic.

Climate change is hard to track and prove precisely. The past five years have been the hottest in history.

Warmer temperatures mean h