To read this full article you need to be subscribed to Institutional Real Estate Americas

Keeping PACE: Property-assessed clean energy financing is a game changer for commercial real estate

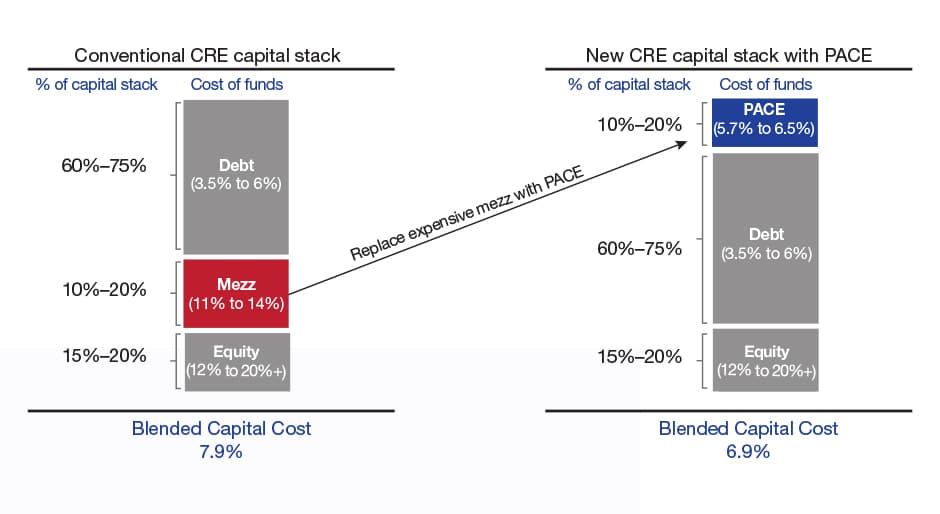

Property-assessed clean energy, or PACE, financing originally was conceived to fund deep sustainability retrofits to existing property, but it has emerged as an ideal source of mezzanine capital to fund new construction or major renovations. PACE financing can serve as an off-balance-sheet, voluntary special improvement district for commercial property owners to finance up to 20 percent of value for all project improvements that involve utility-cost impact or disaster resilience. More specifically, qualified PACE projects include energy/water efficiency, renewable energy, and seismic- or hurricane-strengthening-related property improvements.

PACE financing is an innovative public-private partnership, enabled by state legislation. It uses a land-secured bond that is repaid via semi-annual or annual assessments on the property tax bill — a feature that facilitates pass-through to tenants or hotel guests. The longer repayment terms (often 20 or more years), help make such inv