To read this full article you need to be subscribed to Institutional Real Estate Europe

Behind the figures: Enhanced performance attribution analysis could chip away at idiosyncratic risk

What do you attribute historical periods of good portfolio performance to? Is it mainly due to sector and geographical allocation, or is it all down to asset selection — picking individual buildings with just the “right” characteristics to deliver strong returns?

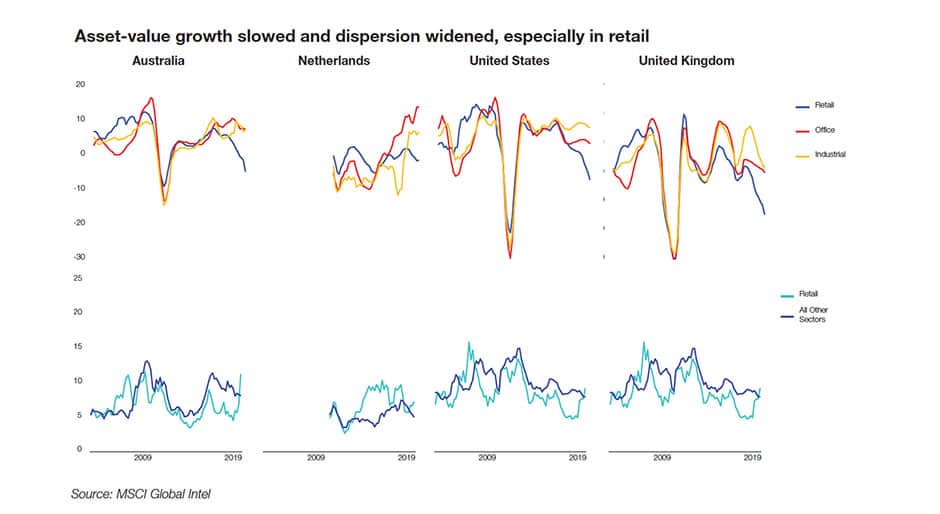

MSCI has analysed how market allocation and asset selection contributed to relative returns between 2008 and 2019 for constituent funds of the MSCI Global Property Fund Index and found that asset selection may have been a particularly important driver of relative performance, especially during times of market stress. On average, over the entire analysis period, asset selection accounted for 70 percent of the annual tracking error between portfolios and benchmarks, with its contribution lower in seemingly more “normal” market conditions, hitting a l