To read this full article you need to be subscribed to Institutional Real Estate Americas

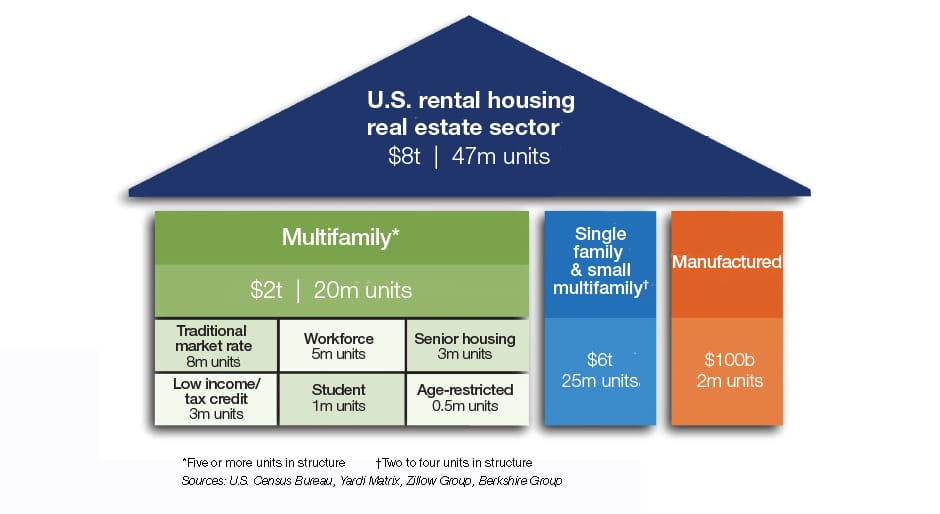

The macro bet: U.S. rental housing is an $8 trillion sector bet

The U.S. housing market is in the midst of a major transformation, shaped by the shifting demographic composition of the population and socioeconomic trends such as urbanization — encompassing higher-density smaller cities and towns within metro areas — and the rise in single living. This transformation is bound to benefit the rental segment, which comprises more than 47 million units with an estimated market value of about $8 trillion, based on current valuations. (The current average sale price of a rental apartment property is about $140,000 per unit, according to Real Capital Analytics, while the average value of a rental home with one to four units is about $230,000, according to Zillow Group.)

While the vast majority of rental housing is owned by individual investors, institutional capital has been steadily gaining market share over the past 30 years, starting with traditional market-rate apartments and, more recently, expanding into subsectors such as student housi