IREI.Q Fundraising Reports

Issues from 2022

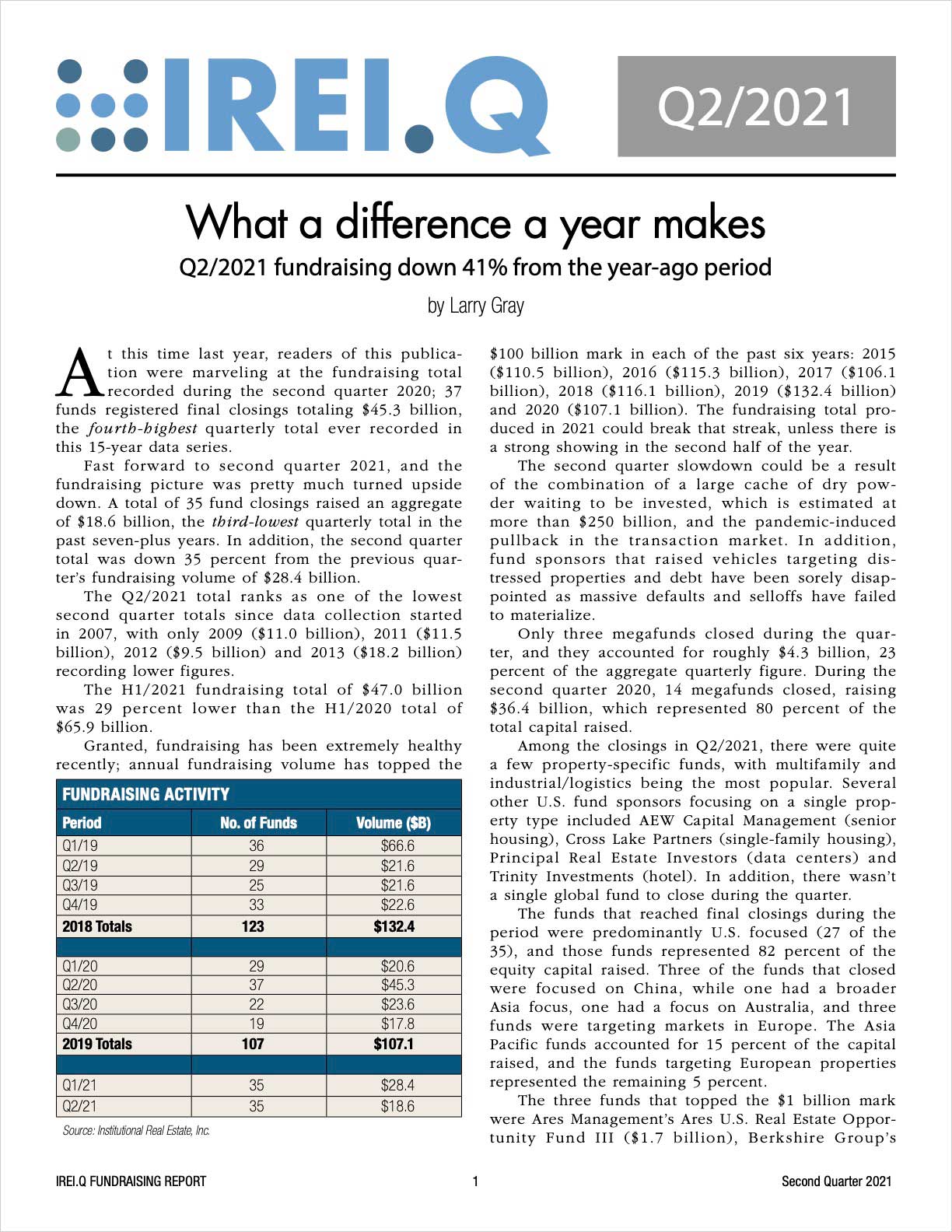

Q3/2022 IREI.Q Fundraising hot sheet

This report features graphs, tables and insights reflecting quarterly and historical fundraising data, facts and trends.

Q3/2022 IREI.Q Fundraising report

Fundraising volume in 2022 has been relatively mediocre through the first nine months of the year, but that could change if the fourth quarter delivers some potential blockbuster closings. During the third quarter 2022, 28 private equity real estate funds announced final closings, raising an aggregate of $21.2 billion, according to Institutional Real Estate, Inc.’s IREI.Q database.

Q3/2022 IREI.Q Funds in the market

Institutional real estate investors have a wide variety of funds to peruse. The 311 funds listed on the following pages are a product of Institutional Real Estate, Inc.’s proprietary database, IREI.Q. They represent a multitude of geographic regions, property types and strategies. Closed-end funds account for a smaller proportion of the funds, with 151 funds seeking to raise an aggregate of approximately $187.6 billion. In addition, the list includes 160 open-end funds for investors to choose from.

H1/2022 IREI.Q Fundraising trends

This report takes a deep-dive into market metrics and trends, such as average fund size, average marketing time, megafunds, emerging managers and dry powder, as well as economic and capital market influences on fundraising.

Q2/2022 IREI.Q Fundraising hot sheet

This report features graphs, tables and insights reflecting quarterly and historical fundraising data, facts and trends.

Q2/2022 IREI.Q Fundraising report

Fundraising activity in 2022 is off to a slow start following a record-setting fourth quarter in 2021. A total of 34 private equity real estate funds recorded final closings during second quarter 2022, raising an aggregate $19.3 billion, according to the IREI.Q database.

Q2/2022 IREI.Q Funds in the market

Institutional real estate investors have a wide variety of funds to peruse. The 289 funds listed on the following pages are a product of Institutional Real Estate, Inc.’s proprietary database, IREI.Q. They represent a multitude of geographic regions, property types and strategies. Closed-end funds account for a large proportion of the funds, with 135 funds seeking to raise an aggregate of approximately $169.2 billion. In addition, the list includes 154 open-end funds for investors to choose from.

Q1/2022 IREI.Q Fundraising hot sheet

This report features graphs, tables and insights reflecting quarterly and historical fundraising data, facts and trends.

Q1/2022 IREI.Q Fundraising report

Following a record-breaking fourth quarter, fundraising activity took a breather during first quarter 2022. During the first three months of the year, 36 fund closings raised a total of $27.1 billion, according to Institutional Real Estate, Inc.’s IREI.Q database.

Q1/2022 IREI.Q Funds in the market

Institutional real estate investors have a wide variety of funds to peruse. The 285 funds listed on the following pages are a product of Institutional Real Estate, Inc.’s proprietary database, IREI.Q. They represent a multitude of geographic regions, property types and strategies. Closed-end funds account for a large proportion of the funds, with 144 funds seeking to raise an aggregate of approximately $117.4 billion. In addition, the list includes 141 open-end funds for investors to choose from.

H2/2021 IREI.Q Fundraising trends

This report takes a deep-dive into market metrics and trends, such as average fund size, average marketing time, megafunds, emerging managers and dry powder, as well as economic and capital market influences on fundraising.

Q4/2021 IREI.Q Fundraising hot sheet

This report features graphs, tables and insights reflecting quarterly and historical fundraising data, facts and trends.

Q4/2021 IREI.Q Fundraising report

Following a fundraising surge that posted a record-setting third quarter total of $40.8 billion, fourth quarter 2021 raised $64.8 billion, the highest fourth quarter total ever recorded, according to the IREI.Q database. In addition to being a record-setting fourth quarter total, the amount raised is also the second-highest quarterly total ever, just behind the mark of $66.6 billion recorded in first quarter 2019.

Q4/2021 IREI.Q Funds in the market

Institutional real estate investors have a long list and a wide variety of funds to peruse. The 253 funds listed on the following pages are a product of Institutional Real Estate, Inc.’s proprietary database, IREI.Q. They represent a multitude of geographic regions, property types and strategies. Closed-end funds account for a large proportion of the funds, with 138 funds seeking to raise an aggregate of approximately $117.2 billion. In addition, the list includes 135 open-end funds for investors to choose from.