RCA: European investment deals dip on economic concerns in 2018

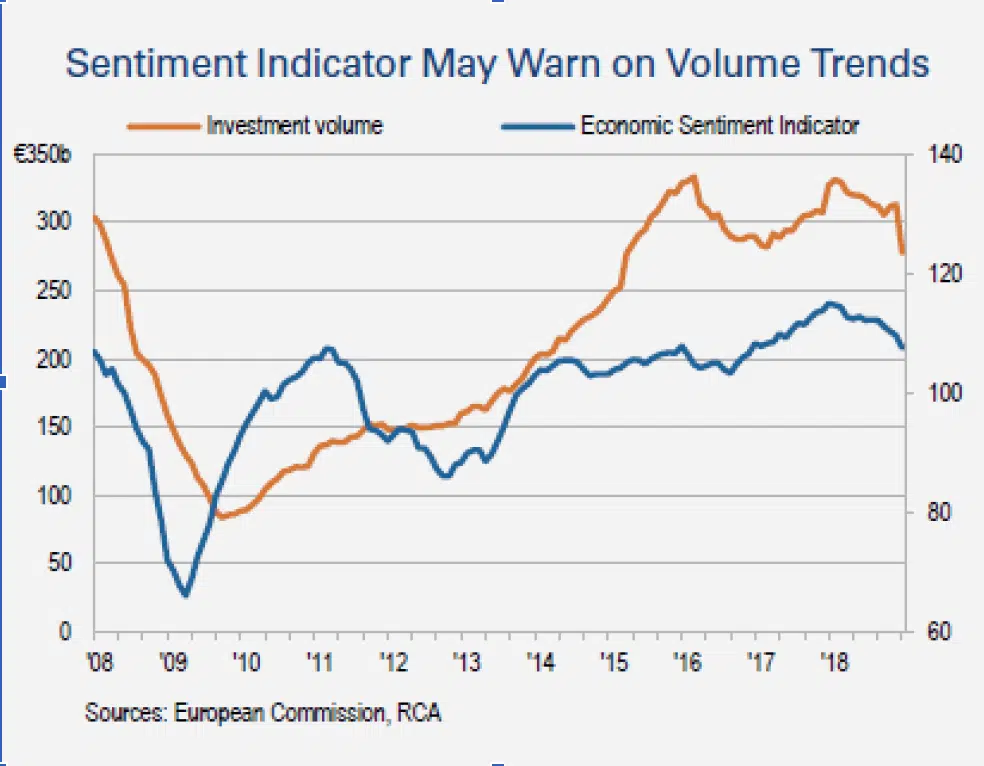

Global geopolitical concerns feeding through into economic sentiment weighed on European real estate investment in 2018, but transaction volumes, although slightly down from a very strong 2017, still hover close to record highs. Investors’ animal spirits do not yet appear to be overly dented by robust pricing while equity is plentiful, Real Capital Analytics’ latest Europe Capital Trends report shows.

Tom Leahy, RCA’s senior director of EMEA analytics, said, “European real estate markets continued to roll through 2018, albeit at a slower pace, but even as geopolitical and economic headwinds such as U.S. rate rises, hard Brexit fears and U.S./Chinese trade tensions blew harder, fourth quarter volumes were still the fourth highest on record. Accommodation and industrial property investors, those in ‘beds and sheds,’ will continue to spend through 2019, but as Europe’s major economies stutter, it is likely overall investment volumes will slow.”

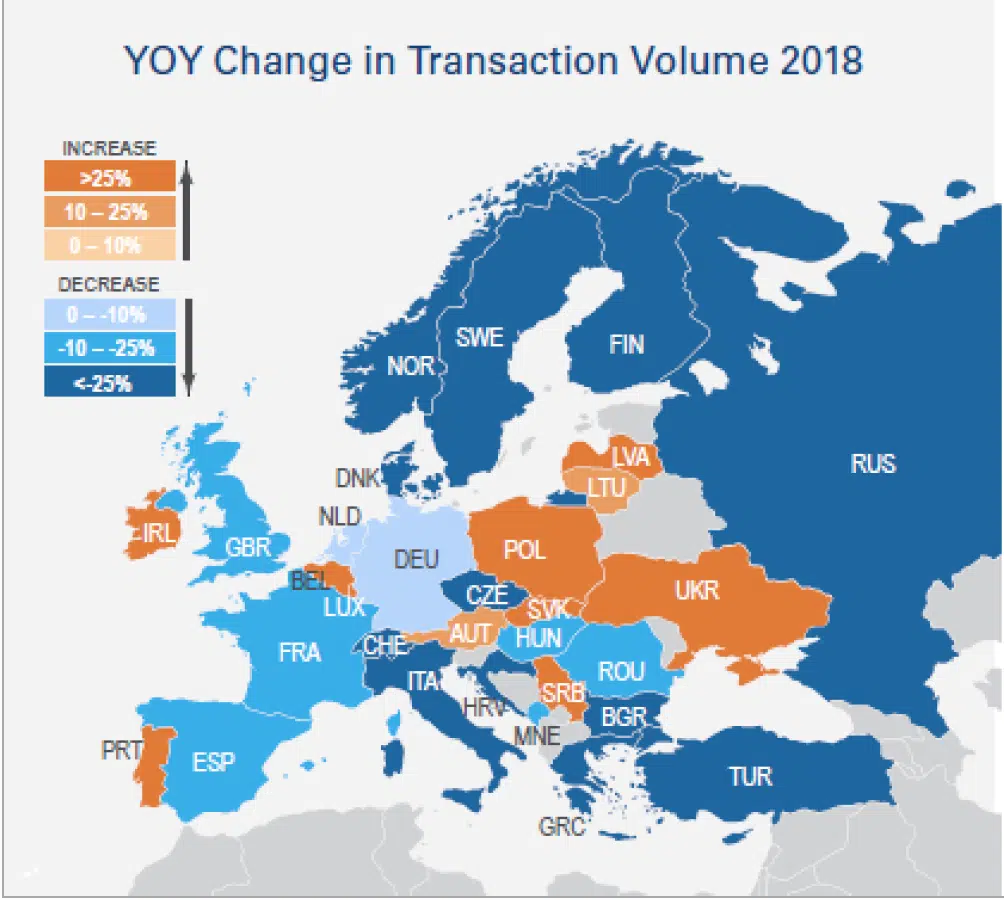

Total European property investment volume was €277.7 billion ($317.31 billion) in 2018, slipping –15 percent over the previous 12 months, with the value of transactions still surpassing the €250 billion ($286 billion) level for the fourth year in a row. Fourth-quarter volume was down 23 percent over the same period in 2017, but the last three months of 2017 was a record three months for the market. The fairly benign overall investment picture does, however, mask some very mixed fortunes at the national level and major developing structural changes in European real estate markets.

Germany overtook the United Kingdom to become the number one European market last year, with the fourth quarter the strongest ever for transaction volumes. In contrast, the combination of Brexit uncertainty and the worst year ever for the retail sector dragged U.K. investor activity, in an unusually weak fourth quarter, to the slowest finish to a year since 2012.

Across Europe, accommodation assets — “the beds” — including apartments, student housing and hotels, now comprise almost 30 percent of all investment volume, which is double their share at the peak of the last cycle in 2007. “The sheds,” industrial/logistics properties, hit a record level of transactions in 2018 for single-asset and portfolio deals on the back of the e-commerce wave, although total volume was down compared with the previous year, due largely to the outsize M&A deals of 2017, notably the €12 billion ($14 billion) Logicor acquisition.

The structural change long under way in some of Europe’s retail property markets appeared particularly bleak in the United Kingdom in 2018, where the sector recorded its worst year ever, with just 344 properties changing hands in deals recorded in RCA’s database — around half the number that traded in 2009 during the depths of global financial crisis. Elsewhere in Europe, the retail story is dramatically different. Markets in Italy, Spain, Poland and Portugal, which are less affected by the online marketplace and the structural oversupply of retail space, continue to attract capital.

The growth in overall European investment volumes in 2018 shifted to smaller markets such as Belgium, Portugal and Ireland, which all saw substantial increases. In Dublin, €725 million ($828 million) was spent on development sites, equal to the previous three years combined. However, these three national markets are less than one-tenth the size of the United Kingdom or Germany.

Frankfurt was the top story within Europe’s biggest markets in 2018. Over €11 billion ($13 billion) was invested in the city last year — more than double the 10-year average — driven by demand for Frankfurt’s many sizeable office towers. There were nine €250 million ($286 million)-plus office transactions over the last 12 months, the same as the previous three years combined. This reflects the health of the occupier market, with vacancy rates at historic lows, strong take-up of space and rising prime rents.

The market was roughly equally split between domestic and overseas buyers’ capital. The largest cross-border deal was the acquisition of the Trianon tower by South Korea’s Hana Financial and IGIS for €670 million ($766 million).

South Korean players were also the top buyers of Central London offices, spending a record €3.6 billion ($4.1 billion) last year, but activity in the United Kingdom’s capital continues to languish at multi-year lows and the fourth quarter of 2018 was particularly slow.

Cross-border investment flows within Europe were at the highest level since 2007. However, as inward global capital flows from outside the region dropped, the European share of the worldwide real estate investment pie has fallen back toward its long-term average, with North America and Asia gaining proportionally.

One of the reasons behind the fall in global inflows was a rapid slowdown in outbound investment by Chinese, and to a lesser extent, Hong Kong players.

Acquisition volumes fell by 80 percent in comparison with 2017, following the government crackdown on overseas purchases of nonstrategic real estate.

Investors are clearly responding to the signs of a maturing market cycle and the potential geopolitical storm clouds on the horizon by holding back from chasing higher returns. The volume of “value-add” deals has fallen every year since 2015, reinforcing the narrative that investment managers are following a “same risk, lower return strategy” as they try not to overstretch.

RCA’s Leahy concluded: “Proceed with caution in 2019 seems to be the main message to European real estate investors from RCA’s latest transactions data. GDP growth across the euro zone was at a four-year low in third quarter 2018, fourth quarter’s flash estimate shows no improvement, and the E.U.’s benchmark European Economic Sentiment Indicator has turned down. There is a strong correlation between the ESI and real estate investment volumes, so if economic sentiment continues to fall, it is likely property transactions will follow suit.”