Megadeals make 2017 Europe’s third most active year on record for commercial real estate investment

Europe’s commercial real estate market had the third most active year on record for investment in 2017 as a result of large portfolio transactions and corporate mergers and acquisitions, research by Real Capital Analytics (RCA) shows.

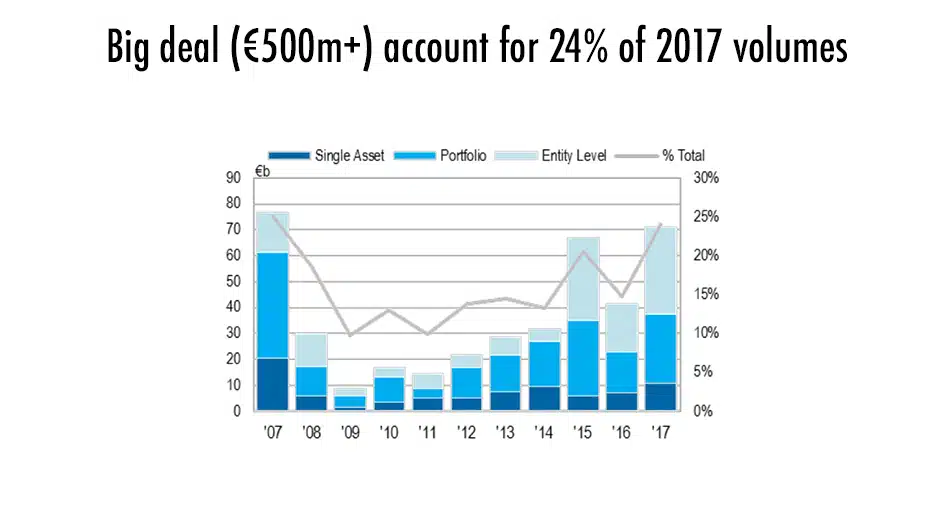

Deals with a minimum value of €500 million ($623 million) accounted for almost a quarter of the €293.4 billion ($365.68 billion) of completed commercial real estate transactions recorded last year by RCA. It was the highest proportion in a decade and the main factor behind a 4 percent rise in overall investment volumes from 2016. Last year ranked behind 2015 and 2007 as the most active for commercial property deals on record.

“Last year was all about the big deal,” said Tom Leahy, RCA’s senior director of EMEA Analytics. “The weight of capital targeting real estate has increased competition for good properties, pushing large investors to deploy their money in portfolios or corporate M&A. It reflects the mid- to late stages of the real estate cycle, which is being sustained by historically low interest rates, accelerating economic growth and subdued inflation.”

China Investment Corp.’s €12.2 billion ($15.21 billion) acquisition of Logicor, a pan-European logistics and warehouse owner, was Europe’s largest portfolio transaction in 2017. RCA analysis shows that 2017 was a record year for real estate corporate M&A, following deals such as Gecina’s takeover of French listed peer Eurosic, and Areim and Blackstone’s take private of Finland’s Sponda. RCA data exclude Hammerson’s takeover of U.K. shopping center owner Intu Properties and Unibail-Rodamco’s proposed acquisition of Westfield.

Last year there were four individual properties sold for prices that exceeded €1 billion ($1.25 billion). The largest was Coeur Défense in Paris’s western business district to Amundi, Primonial REIM and Predica CA Assurances for an estimated €1.8 billion ($2.24 billion). The others were the purchase of London’s Leadenhall Building and 20 Fenchurch Street by Hong Kong–based investors plus the €1.1 billion ($1.4 billion) acquisition of the Sony Center in Berlin by Oxford Properties and Madison International.

RCA’s analysis of pricing trends reveals that, on average, investors are buying at much lower yields in order to acquire larger office buildings. It also found that the shortage of class A stock for sale is supporting a rise in development and forward purchases of properties currently under construction.

Development site purchases rose by 30 percent to €13.6 billion ($16.95 billion) last year, while forward sales totaled €33.7 billion ($42 billion), or 11 percent, of the total transaction volumes in Europe.

“It’s getting so difficult for investors to get their hands on single prime properties in the core European markets that they are prepared to take on some of the development risk to acquire them,” said Leahy. “When sizeable, class-A properties come onto the market, the competition prices them at a premium to comparable smaller assets.”

All of the top five most active European commercial real estate markets registered rising investment volumes last year. The United Kingdom returned to first place after being eclipsed in 2016 by Germany, which ranked second in spite of an 8 percent increase in annual investment in 2017. Spain came in fourth after France following a 35 percent jump in investment to €20.9 billion ($26.1 billion), chiefly concentrated on Madrid, as Catalonian separatists’ bid to secede contributed to a 16 percent drop in investment in Barcelona.

The real estate sector that attracted the biggest increase in investment activity was industrial and logistics warehousing, with a 38 percent rise to €42 billion ($52 billion). This reflects investor confidence that the sector is benefitting from significant changes in supply chain management and as online commerce grabs a growing share of retailing.

Aside from Blackstone’s sale of Logicor, other significant transactions included Global Logistic Properties’ €2.4 billion ($2.99 billion) purchase of Gazeley – another logistics property owner — AXA IM Real Assets’ portfolio acquisition from Gramercy Property Europe, plus Blackstone’s deal with M7 Real Estate to buy the Brockton U.K. industrial Portfolio.

Leahy concluded, “The outlook for Continental Europe’s real estate markets is good as monetary conditions look stable and economic growth feeds through into rents. There is a broad diversity of investors. We expect the French market will have a big year in 2018 after a very strong final quarter last year. In the U.K., strong price growth in the larger regional markets suggests investors are happy to compete to place capital, despite the sense of political uncertainty that has dogged the country since the Brexit referendum.”