Commercial real estate investment across Greater China totals $69b in 2018

Commercial real estate investment across Greater China totaled RMB463 billion ($68.5 billion) in 2018, according to Cushman & Wakefield’s Greater China: Capotal Markets Express 2018 review/2019 outlook report.

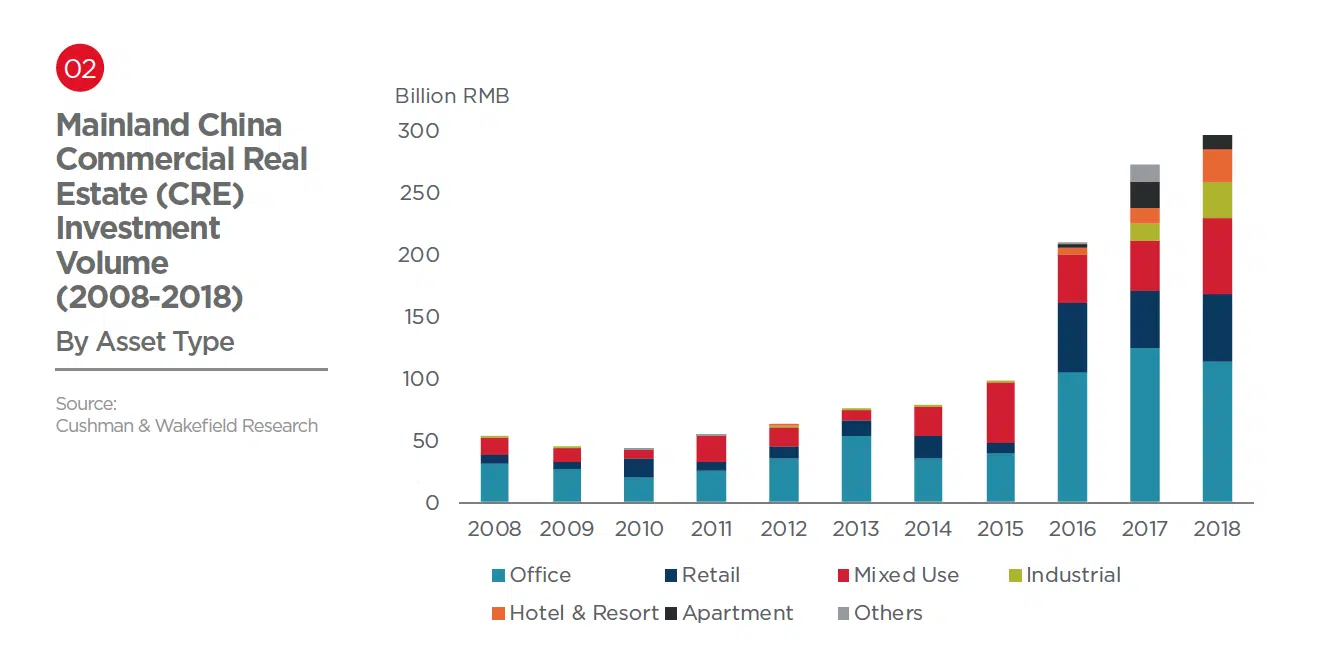

Tiers 1, 2 and 3 city groups all recorded CRE investment growth over the previous year, a sign of the investment market’s stable development across the nation. Office properties remained the preferred asset class.

Active foreign capital demonstrated a preference for China’s Tier-1 cities in 2018 with investment accounting for nearly 99 percent of total foreign investment in China.

With vendors’ expectations and supply pipelines softened, Cushman & Wakefield reported, end-user leasing demand for office premises remaining robust. The result: a new record high, with mainland China CRE investment climbing 9.5 percent over the previous year, accounting for a formidable RMB296 billion ($43.8 billion).

The firm predicted Shanghai and Beijing will remain attractive and should see reasonable transaction volumes in 2019. However, other areas have garnered particular attention of late. Cushman & Wakefield forecasted that Shenzhen, Guangzhou and Hong Kong are set to see increased demand through 2019. Beyond core cities of the Greater Bay Area, the firm also noted strengthening rationale for investment in not so well known cities such as Zhuhai, Zhongshan, Foshan and Dongguan.

Elsewhere in China, key provincial capital cities are also likely to pop up on an increasing number of investors’ radar, including cities such as Nanjing, Hangzhou, Wuhan, Changsha and Chengdu.

To read the full report, click here.