CMBS delinquency rate falls 5 bps in May

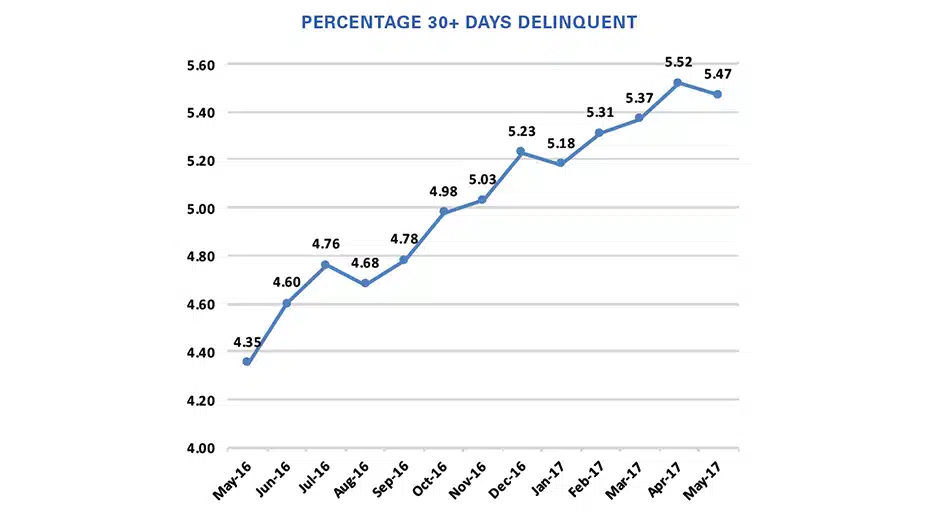

The U.S. CMBS delinquency rate fell modestly in May, dropping to 5.47 percent, a decrease of 5 basis points from April, according to Trepp.

After hitting a post-crisis low in February 2016, the reading has consistently climbed over the past year as loans from 2006 and 2007 have reached their maturity dates and have not been paid off via refinancing. The rate had moved up in 12 of the past 14 months before the May reading.

The rate is now 112 basis points higher than the year-ago level, and 24 basis points higher year-to-date. The reading hit a multi-year low of 4.15 percent in February 2016. The all- time high was 10.34 percent in July 2012.

Although the overall delinquency rate decreased in May, readings for four of the five major property types moved higher. The industrial delinquency rate moved up 22 basis points to 7.37 percent, while lodging jumped 20 basis points to 3.42 percent. The office delinquency rate fell 51 basis points to 7.46 percent, while retail increased 20 basis points to 6.5 percent. Apartment loans remained the best performing major property type, despite climbing 16 basis points to 2.82 percent.

About $1.7 billion in loans became newly delinquent in May, which put 40 basis points of upward pressure on the delinquency rate. About $1.15 billion in loans were cured last month, which helped push delinquencies lower by 27 basis points. In addition, about $735 million in CMBS loans that were previously delinquent were resolved with a loss or at par in May. Removing those previously distressed assets from the numerator of the delinquency calculation moved the rate down by 17 basis points.

Trepp predicts that as pre-crisis loans reach their balloon dates, the delinquency rate should continue to inch higher over the next few months.