Annual and permanent cropland returns continue to converge in first quarter

The total return for the NCREIF Farmland Index first quarter was 0.70 percent, down from 2.85 percent the previous quarter, and 1.32 percent in the first quarter of 2018, according to National Council of Real Estate Investment Fiduciaries.

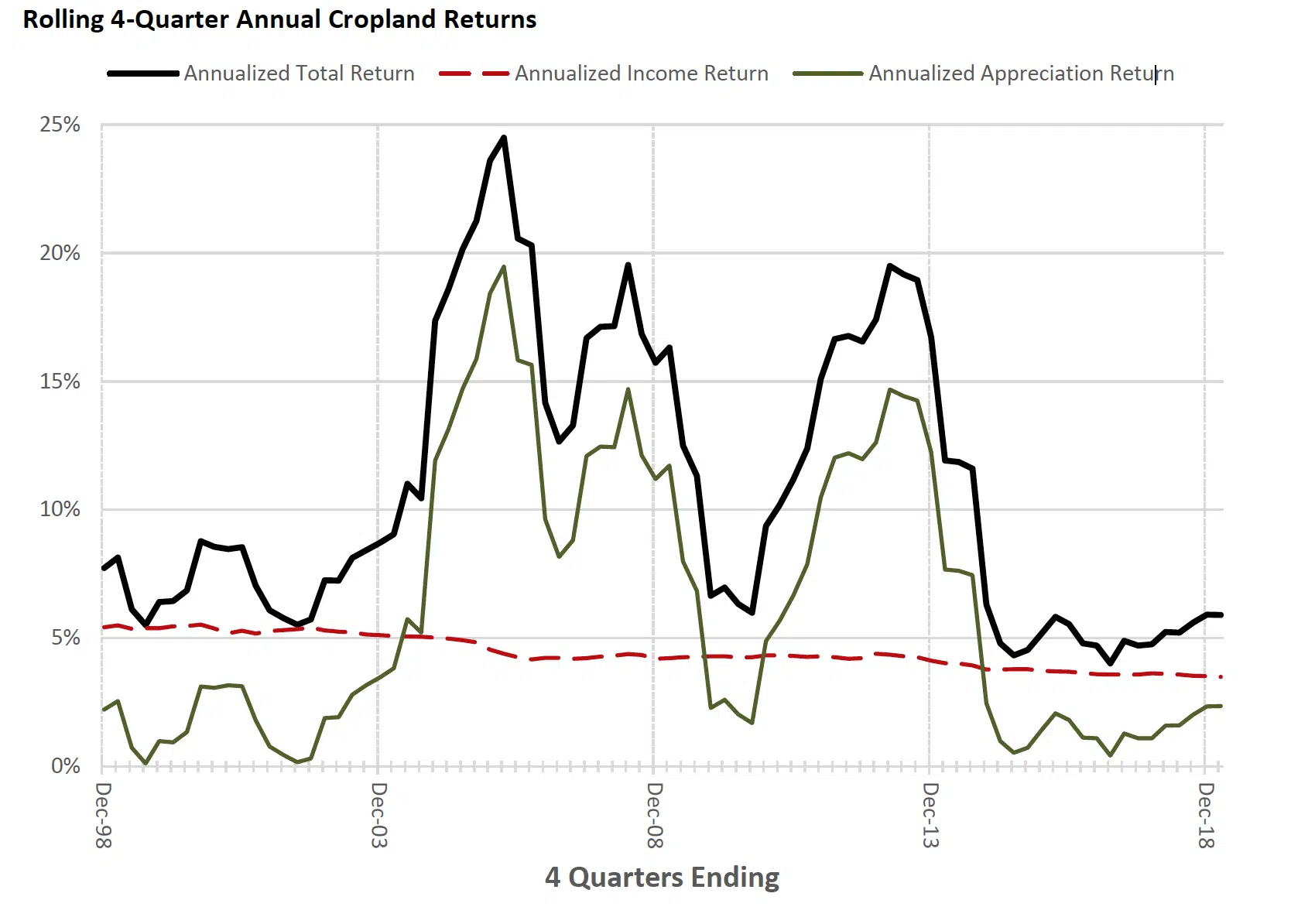

The quarterly total return was comprised of a 0.54 percent income return and appreciation of 0.16 percent. First quarter income return for the Total Farmland Index was 3 basis points higher than last year when the first quarter income return was 0.51 percent. Farmland values continued a marginally positive trend in the first quarter, posting appreciation of 0.16 percent after registering appreciation of 0.66 percent in third quarter.

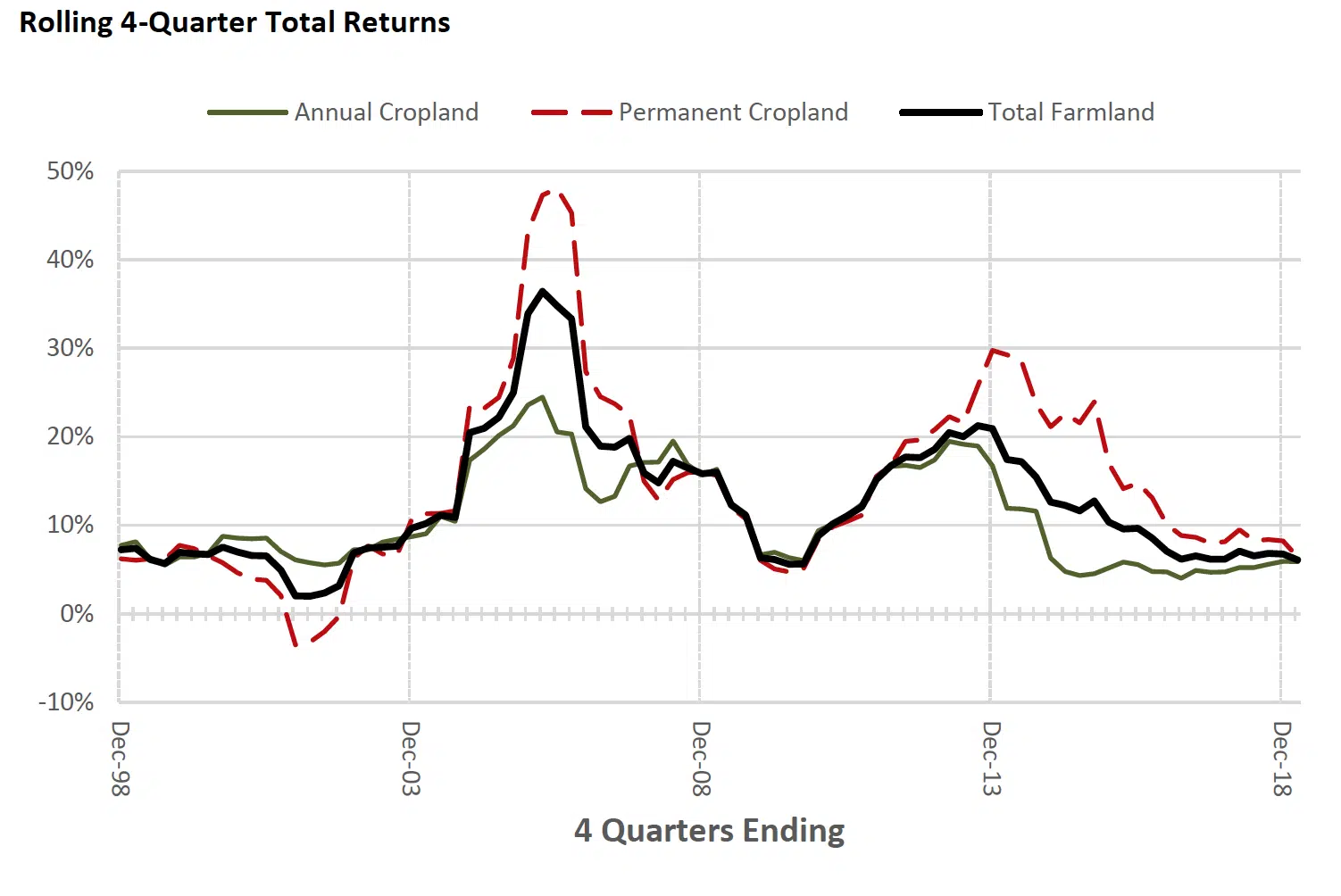

The trailing four-quarter total farmland return was 6.08 percent through first quarter 2019, compared to 7.07 percent for the four quarters ending in the first quarter 2018. The annual total return was comprised of a 4.5 percent income return and 1.54 percent appreciation.

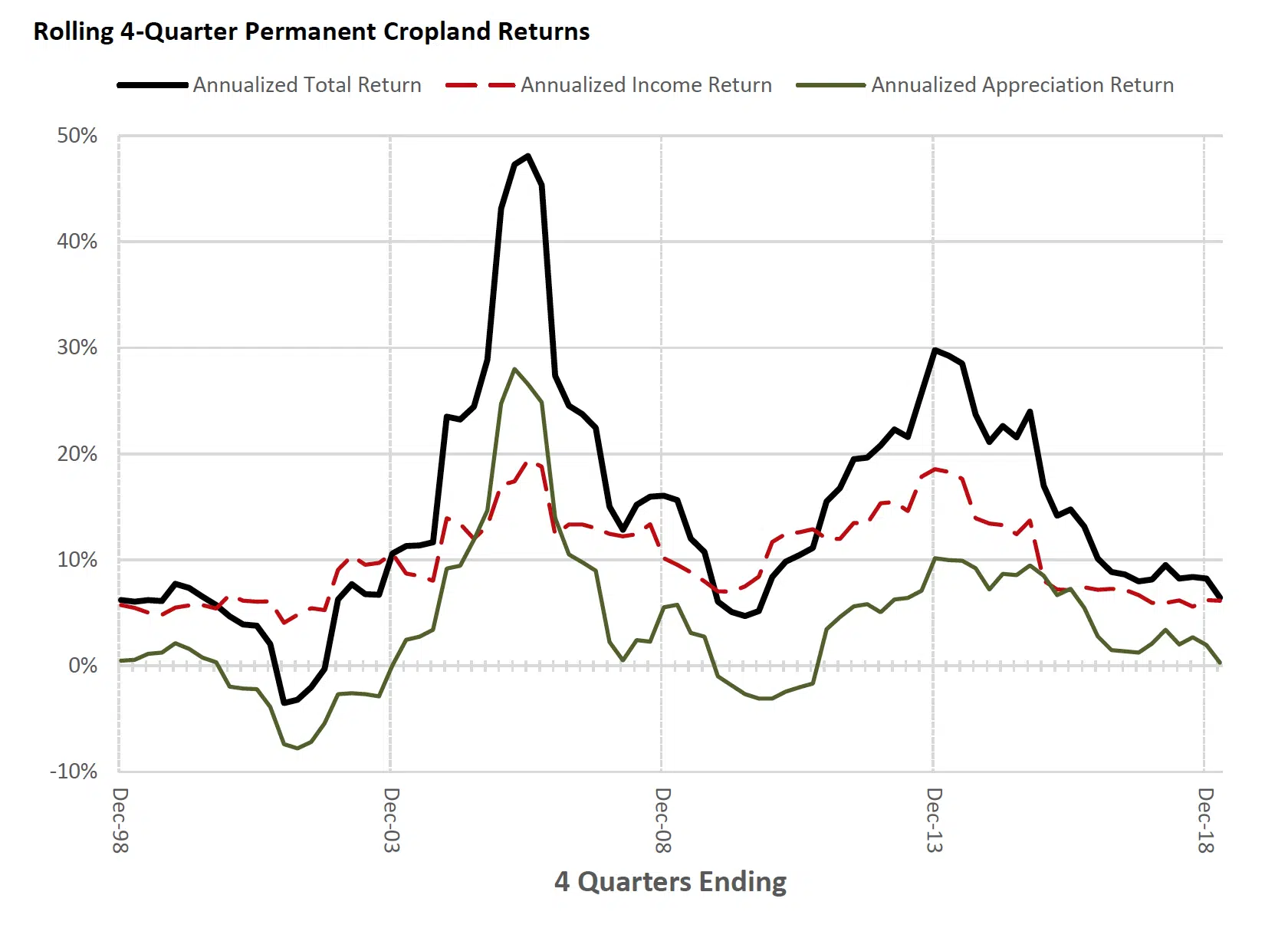

Annual cropland outperformed in the first quarter with quarterly total returns of 1.35 percent for annual cropland and –0.43 percent for permanent cropland. Annual cropland outperformed on both income and appreciation, with an income return of 0.85 percent and appreciation of 0.50 percent. Permanent cropland performance for the quarter was split between its income return of 0.00 percent and appreciation of –0.43 percent. Over the trailing year, annual cropland returned 5.90 percent, compared to 6.44 percent for permanent cropland. Since inception, total returns for these two categories have a similar narrowing gap with annualized returns of 12.08 percent for permanent cropland and 10.24 percent for annual cropland.

Seven of the eight NCREIF regions registered positive total returns in the first quarter. The Southeast (3.71 percent), Mountain (1.89 percent), and Southern Plains regions (1.86 percent) led regional performance for the quarter, with the Pacific West (–0.16 percent) the sole region to post a negative total return. All regions posted positive income for the quarter, while two regions, Pacific West (–0.36 percent) and Corn Belt (–0.16 percent), posted negative appreciation. This was the first quarter in nearly three years that the Lake States Region has posted positive appreciation.

The NCREIF Farmland Index consists of 901 investment-grade farm properties, totaling $10.4 billion of market value. These farm properties are comprised of 668 annual cropland properties and 233 permanent farmland properties. The index includes 245 properties in the Corn Belt, 224 in the Pacific West, 137 in the Delta States, 75 in the Mountain States, 64 in the Southeast, 55 in the Pacific Northwest, 44 in the Lake States and 22 in the Southern Plains. The index includes data provided by the following firms: Gladstone Land, Hancock Agricultural Investment Group, Prudential Agricultural Investments, UBS Farmland Investors, US Agriculture, and Westchester. This data enhances the ability of institutional investors to price the risk of farmland investments across the Unit