Narrowing down the alternatives: Three megatrends in housing, healthcare and technology will support investments in alternative real estate

Three megatrends — a continued shift toward renting, a transformation of the U.S. healthcare system and a rise in the digital economy — will drive long-term outperformance in the alternative housing, healthcare and technology real estate property types.

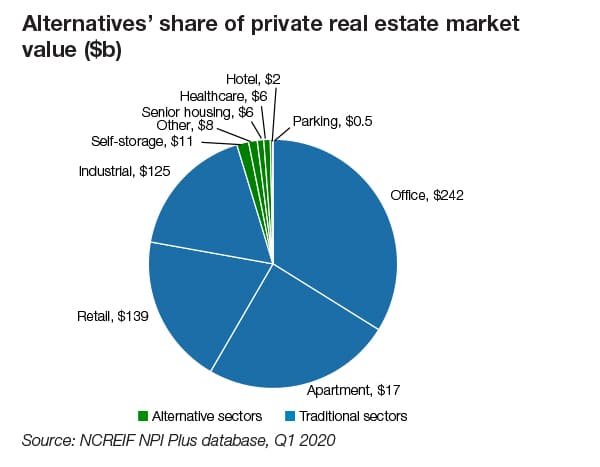

The alternative sectors are likely to become more mainstream in the next decade as COVID-19 has investors realizing how crucial it is to increase diversification within their real estate portfolios. NCREIF data suggest most investors within NFI-ODCE funds have very little exposure to the alternative property types.

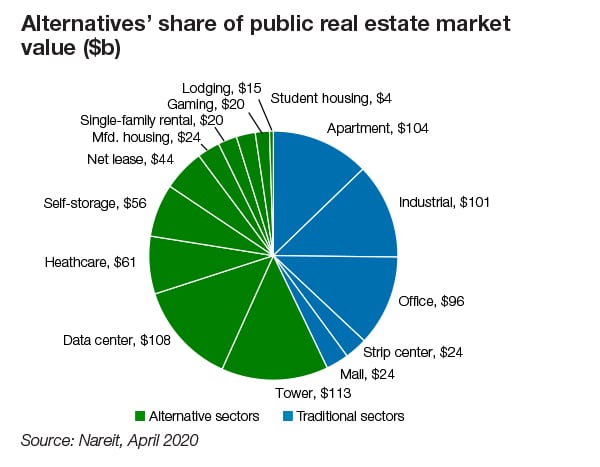

By contrast, as of first quarter 2020, the majority of the public real estate market’s market capitalization was within the alternative real estate property types.

This view takes into account changes brought about by COVID-19. And, if anything, COVID-19 has accelerated the already strong tailwinds driving these sectors. During COVID-19, these sectors proved their resiliency relative to most of the traditional property types. Historically, these sectors have outperformed traditional real estate sectors through economic cycles, and they will continue to do so for the next decade.

The post-COVID-19 world will be one of slow economic growth as the U.S. faces a record amount of debt. This means real estate investors should focus on real estate property types that can generate superior NOI growth without needing significant economic growth to do so. Much of the future outperformance across the alternative property types is driven by their greater NOI growth and lower cap ex requirements. In our view, housing, technology and healthcare real estate property types will be able to generate superior NOI growth relative to other real estate types because their fundamental drivers are tied to less economically sensitive sectors. We look at just three of the alternative subsectors that we believe are well placed to continue to perform.

Megatrend 1: Changing U.S. demographics to drive demand for rental housing

Undeniably, there will be demographic shifts in the United States during the next 10 years, reshaping housing markets. The aging of millennials and baby boomers have profound implications for alternative housing sectors. These demographic shifts will fuel future demand for single-family rentals, senior housing and manufactured housing.

Subsector spotlight: single-family rentals — Single-family rentals are a sizable investment opportunity, representing 34 percent of the total U.S. rental market with nearly 15 million rental units, according to the Joint Center for Housing Studies’ tabulations of the U.S. Census Bureau’s American Community Survey One-Year Estimates. And single-family rentals comprise 18 percent of total occupied U.S. single-family housing stock, according to the Census Bureau.

A review of Invitation Homes filings, public company home counts from public filings, and private company home counts estimated using HouseCanary data reveals the single-family rental market is 98 percent dominated by noninstitutional players. In recent years, REITs and private players have entered the single-family rental market, starting the institutionalization of this space.

According to a June 2020 Nareit presentation by Invitation Homes, the largest single-family rental owner in the United States, the average resident age is 39 years, with an average annual household income of approximately $110,000. The demographic wave into the prime single-family rental age cohort will be accelerating in the next 10 years as millennials age — the oldest being 39 years currently — and are unable to afford homeownership.

Purchasing a single-family home would be the next natural step for millennials as they age. However, millennials have experienced two recessions (GFC and COVID-19) in their young adult lives, and many are unable to afford a down payment and mortgage. This will be a key future driver of single-family rental demand.

Megatrend 2: Transformation of the U.S. healthcare system

Healthcare is the fastest-growing sector in the U.S. economy and accounts for nearly one-fifth of GDP, according to OECD Health Statistics 2019. Healthcare-centric real estate will continue to grow in importance during the coming decades, particularly in light of COVID-19. COVID-19 could spark more research into finding vaccines for future pandemics. Drug development is a key driver of life sciences demand. From a medical office perspective, given the high spend on healthcare in the U.S. relative to other developed nations, as well as the rise of telemedicine, we believe more care will be delivered outside of hospitals in more cost-effective settings such as medical offices and, in particular, in medical offices that offer higher acuity services that cannot be delivered via telemedicine.

Subsector spotlight: life sciences — Medical discovery and innovation is integral to an aging population. Life sciences real estate provides space for research institutions, pharmaceutical companies, biotechnology firms and medical device companies to conduct research and development.

Single-industry exposure is a key risk for the life sciences sector, as tenants in this space are within the biotech and medtech industries. Tenant profiles range from established Fortune 500 companies to startup companies that may not earn FDA approval for their products or treatments. It is important for investors to evaluate the credit of novice tenants (i.e., startups) in the event they are defunct within the lease term.

Outperformance in the life sciences sector began in 2015, after the sequencing cost per human genome dropped sharply from $6,000 to $1,000 in one year through the use of artificial intelligence, according to the National Human Genome Research Institute (figures rounded to the nearest thousand). Since this scientific breakthrough, life sciences real estate returns have exceeded traditional office returns. Further, the life sciences sector has experienced higher NOI growth than the traditional office sector due to a shortage of lab space supply.

Megatrend 3: Rise in the digital economy

Data centers, cell towers and their associated real estate components are an ecosystem of interrelated communications supported by the growth in data consumption. The growth of global internet traffic, mobile-to-mobile (M2M) connections, and “next generation” innovation, from artificial intelligence to the internet-of-things, will continue to propel the sector’s demand. While the majority of the data center market is owned by publicly traded REITs, the sector has promising secular tailwinds and risk-adjusted returns can generate alpha in private real estate portfolios.

Subsector spotlight: data centers — A data center is a highly specialized facility housing critical IT infrastructure for corporations, governments and other organizations. Data centers are the physical buildings housing and facilitating the flow of information that make up the internet. These facilities provide a highly reliable, secure environment with redundant mechanical, cooling, electrical power systems and network communication connections. Data centers play a critical role in the data “supply chain.”

The data center industry was a $38 billion industry based of revenue in 2018, and is expected to grow at a 10 percent CAGR annually for the next several years. This growth is being driven by: (i) the total online video and web content consumption as users increasingly abandon TV for time-shifted shows other digital streaming and other platforms; (ii) the migration of enterprises outsourcing their data centers to third-party managers (65 percent of companies still have data storage in-house); and (iii) continued growth in mobile traffic from the rise of big data to the internet of things, all of which create demand for data centers (servers and ability to interconnect and share information server-to-server).

The fundamentals of data centers, particularly colocation markets, are sound. Data center markets have strong fundamentals as companies of all sizes are taking advantage of the “pay as you go” model offered by colocation for connectivity and cloud services for inexpensive storage and processing power. Outsourcing data centers allows employees at IT departments to buy the power and space needed today and add more as required, which becomes more of an operating expenditure decision rather than a capital expenditure one.

Housing, technology and healthcare real estate performance during and after COVID-19

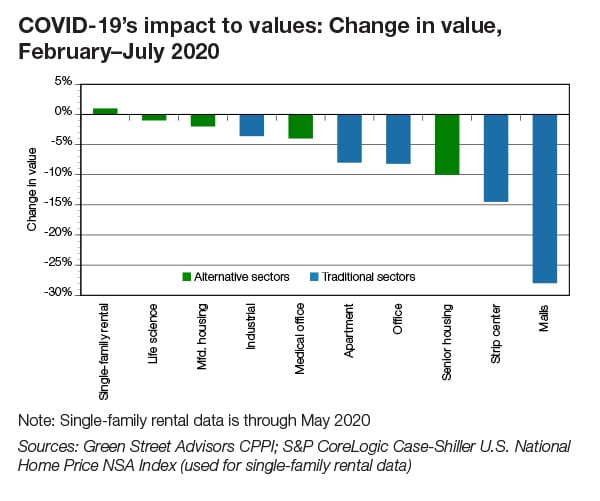

Throughout the COVID-19 pandemic, alternative sectors have proven to be more resilient than traditional sectors as evidenced by the smaller valuation impact.

Single-family rentals maintained healthy operating fundamentals throughout the apex of the COVID-19 pandemic. Invitation Homes, the largest institutional owner of single-family rentals, reported strong rent collections, same-store occupancy and same-store new leasing spreads. As of July, the company collected 98 percent of its April rents, 97 percent of May and 96 percent of June versus 92 percent in July. Additionally, the firm’s same-store occupancy reached a record-high of 97.8 percent in July, an increase of 170 basis points year-over-year.

The life sciences sector showcased its resiliency amid COVID-19 market volatility as pharmaceutical and biotechnology tenants developed therapies and repurposed drugs to treat and cure COVID-19 patients. During the pandemic, life sciences returns outperformed office returns and overall real estate and had higher rent collection than office. Alexandria (ARE), a major life sciences REIT, reported rent collections of more than 99 percent in June and July versus the office average, according to NCREIF, of approximately 90 percent as of mid-July. In our view, the life sciences sector will continue to outperform in the post-COVID-19 environment as the need for drug testing, therapies and vaccines for future virus outbreaks will continue to fuel demand.

Data centers increased in importance throughout COVID-19 as large companies modified their IT infrastructures to ensure their employees could effectively work from home. Equinix, the largest data center REIT and fifth-largest REIT, claimed in its first quarter earnings release that many of its data centers were identified as “essential businesses” or “critical infrastructure” by local governments for purposes of remaining open during the COVID-19 pandemic, and all data centers remained operational throughout the pandemic.

Conclusion

We believe future real estate portfolios will need to expand beyond the four main property types, and we see the opportunity to capitalize on the following investment themes in alternatives:

- Resilience and diversification: Demand drivers rely less on economic growth and more on demographics, healthcare and technology, positioning them for resilience and outperformance throughout cycles and offering diversification.

- Fragmented sectors: By targeting sectors and assets with fragmented ownership, institutional owners can drive efficiencies and outperformance.

- Continued outperformance: During the past decade, the alternative property types outperformed traditional property types by 275 basis points and are projected to continue to do so by 130 basis points.

Melissa Reagen is head of research, Americas, at Nuveen Real Estate. This is an excerpt from an extensive analysis of real estate alternatives subsectors conducted by Nuveen Real Estate’s research team. Reagen will dive deeper into alternative investment strategies in a webinar on Oct. 7. Register for the complimentary webinar here. For more information, please contact Wendy Pryce, Nuveen real estate specialist, at +1 212-207-2064 or wendy.pryce@nuveen.com.