To read this full article you need to be subscribed to Institutional Real Estate Europe

Defensive strategies underpin recent M&A activity

E-commerce disruption has provided the backdrop to two significant M&A plays in the owner and developer space.

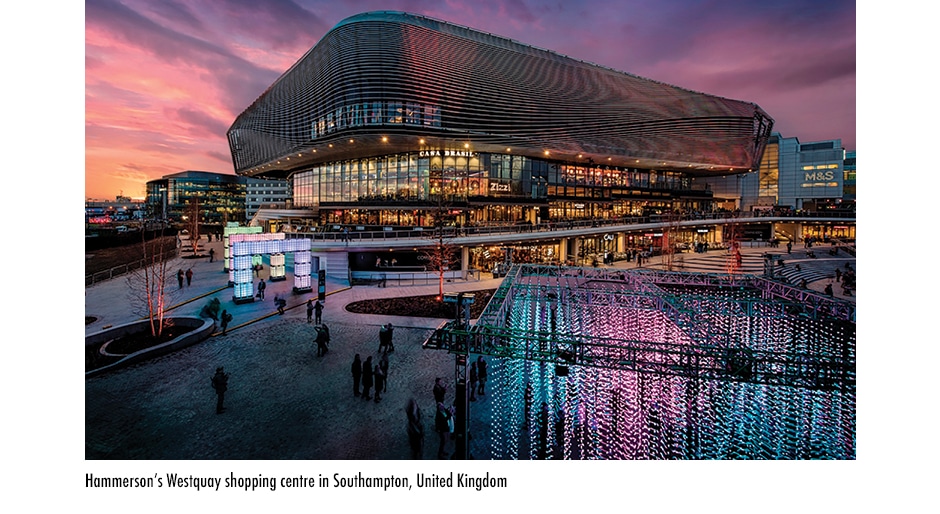

Hammerson’s proposed £3.4 billion (€3.8 billion) acquisition of Intu Properties could create a £21 billion (€23.6 billion) leading European retail REIT based on a portfolio of high-quality retail and leisure destinations. Hammerson and Intu both have major assets in the United Kingdom and the deal would allow Hammerson to add Spanish locations to its additional list of French and Irish properties.

If the purchase is rubber-stamped — it may well be investigated by the UK’s Competition and Markets Authority due to the monopoly that Hammerson will have over the prime retail market in the country — then Hammerson has said it would sell about £2 billion (€2.3 billion) of real estate in its home country to focus on faster growing economies such as Ireland and Spain.

When the details of the offer for Intu were announced, John Strachan, the