To read this full article you need to be subscribed to Newsline.

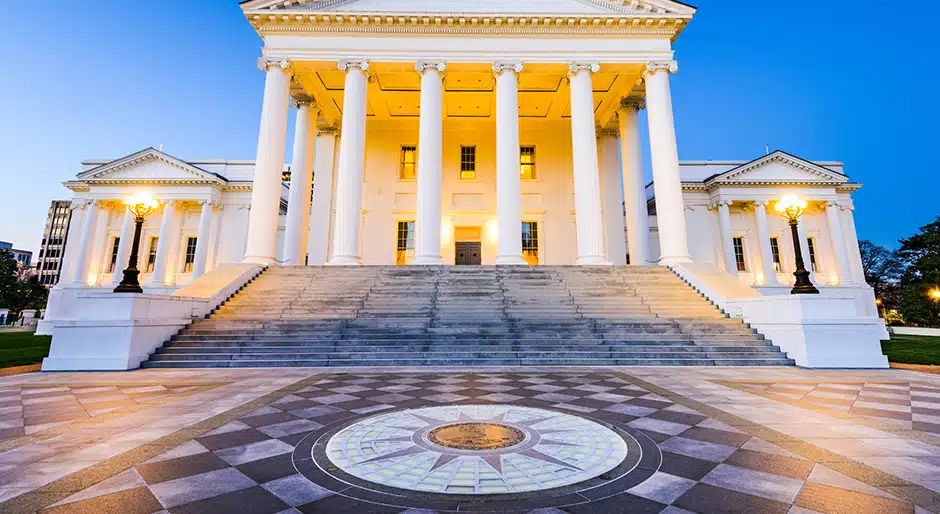

Sign in Sign up for a FREE subscriptionVirginia Retirement System commits $125m to value-added real estate fund

The Virginia Retirement System has committed $125 million to Westbrook’s real estate fund, according to Jeanne Chenault, public relations director for the retirement system.

Westbrook Real Estate Fund XI is a U.S. opportunistic real estate fund managed by Westbrook Partners, a New York–based privately-owned, fully integrated real estate investment management company. The value-added real estate fund will invest in major asset classes globally, with a focus in Western Europe, the United States and Japan.

The previous fund in the series, Westbrook Real Estate Fund X held a $2.85 billion final close in 2016.

Westbrook’s experience includes the operation and management of office, multifamily residential, hotel, retail, industrial and single-family residential development properties. Westbrook has raised and invested more than $14 billion of equity in over $50 billion of real estate transactions in major markets throughout the world.