Virginia commits $75m to real estate fund

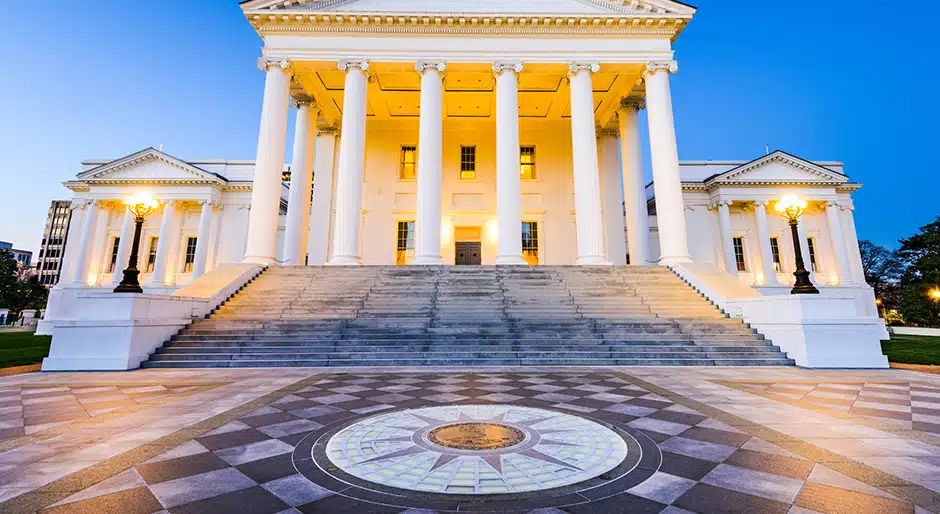

The $78.3 billion Virginia Retirement System has committed $75 million to Artemis Real Estate Partners Fund III, according to Jeanne Chenault, public relations director for the pension fund.

Just like previous funds in the series, Artemis Real Estate Partners Fund III is a value-add/opportunistic fund that will invest in the United States with a focus on the multifamily, office, industrial, retail, senior housing and self-storage sectors. The fund has raised $661.05 million so far.

The fund’s predecessor, Artemis Real Estate Partners Fund II, held a $580 million final close in 2014. The value-add/opportunistic fund surpassed its $500 million target. It seeks situational distress and transitional assets in recovering and growth markets. Artemis Real Estate Partners Fund I held a $436 million final close in 2012.

Artemis has raised more than $3.3 billion of investor equity in two primary business lines: $2.2 billion in a commingled fund series (core plus, value add and opportunistic) and more than $1.1 billion in separate accounts focused on emerging managers. Artemis’ sole focus is U.S. commercial real estate.