To read this full article you need to be subscribed to Newsline.

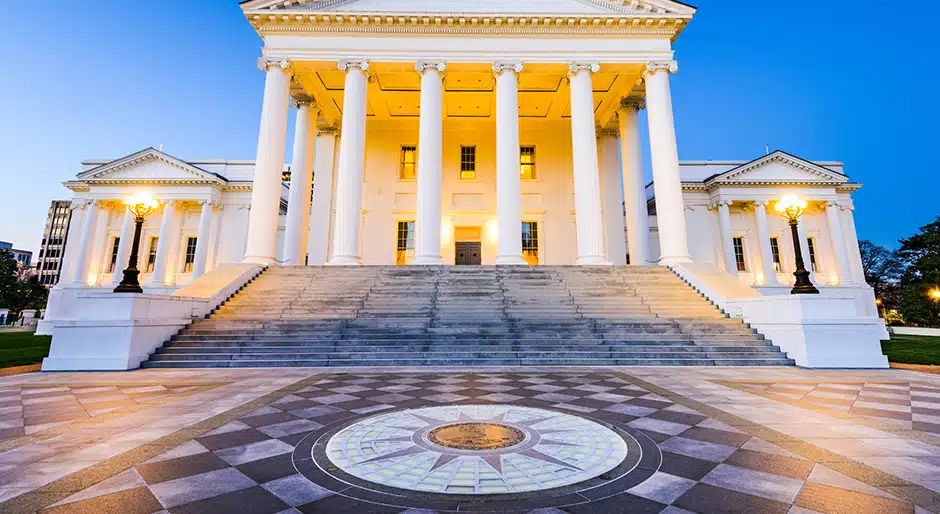

Sign in Sign up for a FREE subscriptionVirginia Retirement System commits $150m to global real estate fund

The $80.4 billion Virginia Retirement System has committed $150 million to the KKR Real Estate Credit Opportunity Partners II (KKR RECOP II), managed by KKR.

The pension fund will invest in VRS’ Credit Strategies program, over a two-year period. This is its first investment in the fund series.

The global debt fund launched in March.

The first fund in the series, KKR Real Estate Credit Opportunity Partners, closed with $1.1 billion in 2017. Both funds in the credit opportunity series focus on generating attractive risk-adjusted returns for investors through the purchase of junior tranches of commercial mortgage–backed securities (CMBS).

KKR is a global investment firm that manages multiple alternative asset classes, including private equity, energy, infrastructure, real estate and credit, with strategic partners that manage hedge funds. As a global provider of equity and