To read this full article you need to be subscribed to Newsline.

Sign in Sign up for a FREE subscriptionSDCERS to invest $65m in U.S.-based CBRE core partners fund

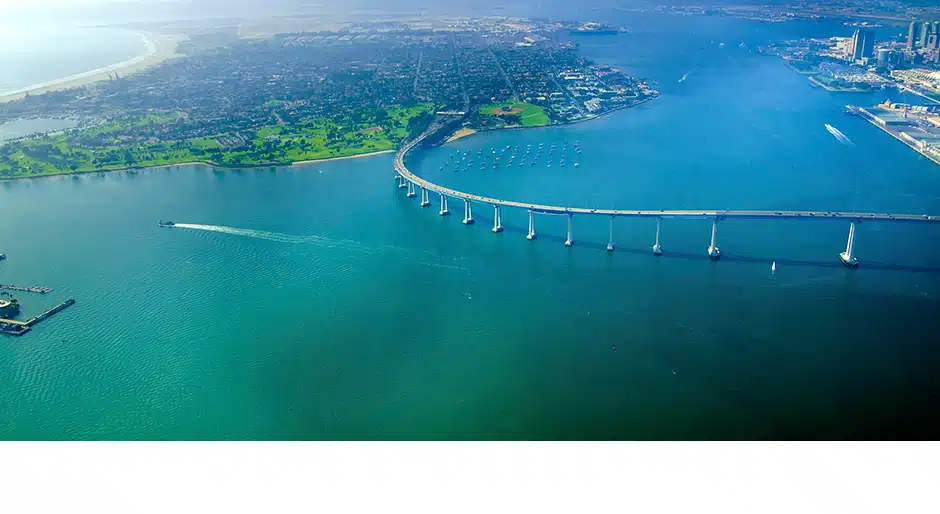

The San Diego City Employees’ Retirement System (SDCERS) has earmarked $65 million for the CBRE U.S. Core Partners (USCP) Fund, managed by CBRE Global Investors, according to a recently released board document.

Launched in 2013, the open-end commingled fund seeks to invest in high-quality, income-producing assets throughout the United States, primarily in the industrial sector.

SDCERS is currently also committed to three CBRE value-add funds: CBRE Strategic Partners U.S. Value 6, 7, and 8. The pension fund is looking to continue its long-standing relationship with CBRE through future commitments, according to SDCERS.

USCP has several property type exposures that benefit the pension fund’s portfolio, specifically the fund’s office underweight and exposure to niche alternative property types, such as self-storage and cold storage. Core properties make up the majority of SDCERS’ portfolio, representing 86 percent, but that is expected to decrease to 70 perc