Few prime commercial assets in Europe offer yields above 5%

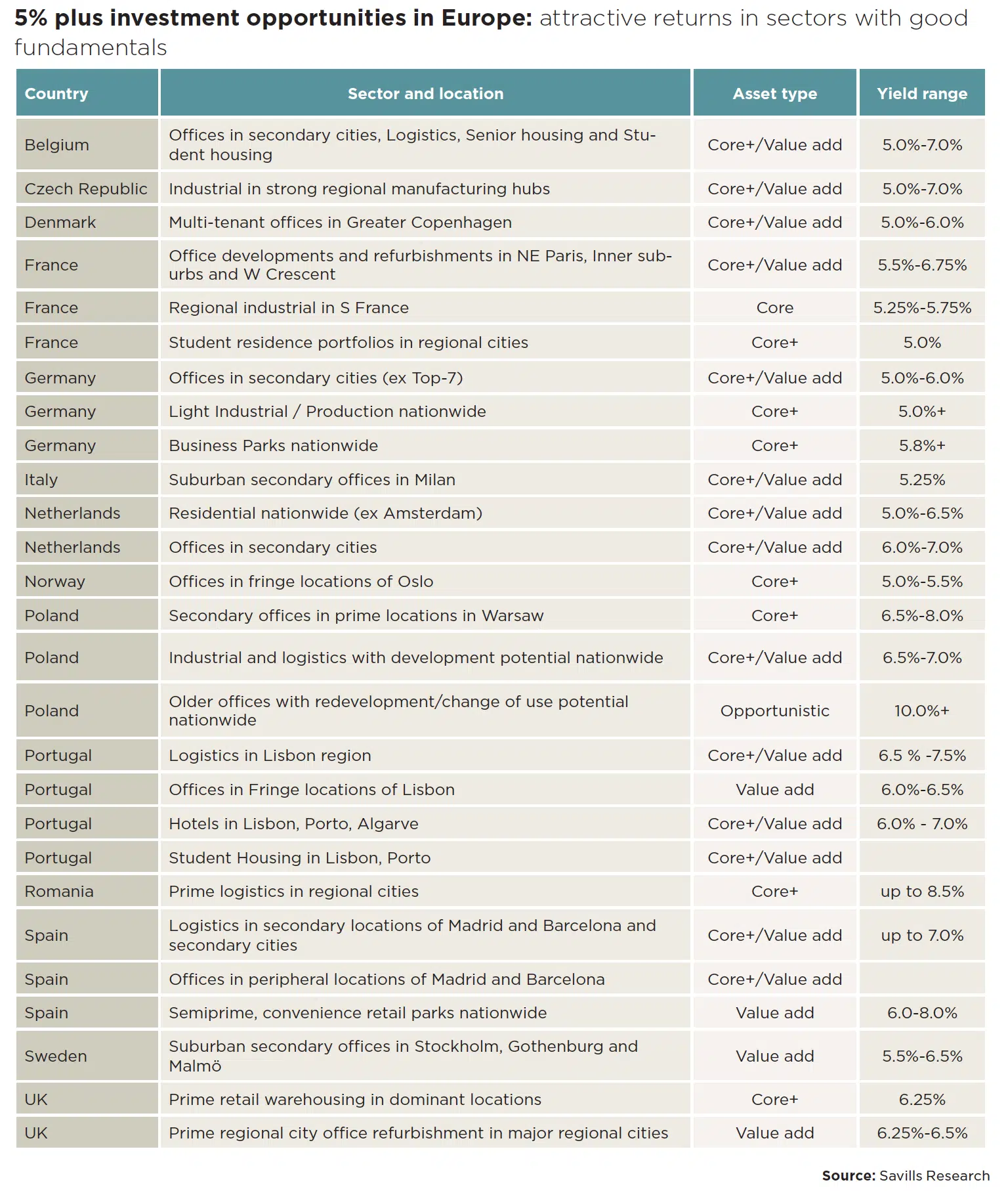

The only prime commercial assets in Europe offering yields above 5 percent are prime logistics warehouses in markets such as Denmark, Czech Republic, Spain, Italy, Portugal, Romania and Belgium, along with prime offices and shopping centers in Athens and Bucharest, and prime shopping centers and retail parks in the United Kingdom, according to Savills’ latest research.

“In what is expected to remain a low interest rate environment going forward, yield spreads will still remain attractive for those investing in European real estate,” said Marcus Lemli, head of European investment and CEO of Savills in Germany. “Falling expectations of an interest rate rise will continue to attract capital into European real estate as borrowers are able to access debt cheaply. The European composite prime CBD office yield hardened 11 basis points to 3.7 percent between January 2018 and January 2019, still providing an attractive yield spread of 250 basis points over the cost of long-term debt.”

The average prime yield across Europe for CBD offices stands at 3.7 percent, with shopping centers at 4.8 percent and logistics warehouses at 5.4 percent, according to first quarter estimates by the international real estate adviser. Investors looking to achieve higher yields could look for core-plus/value-add opportunities in the Nordics and South Europe for offices, secondary cities in Southern and Eastern Europe for logistics, the United Kingdom and Spain for retail, and Southern and Central Europe for purpose-built student accommodation opportunities.

Eri Mitsostergiou, director, Savills European Research, added, “For investors looking for higher returns, there are core-plus/value-add opportunities in market segments with solid fundamentals, such as secondary offices. Most capitals in Europe suffer from undersupply of space in central locations in particular. As a result demand for quality offices in well-connected fringe locations is solid, and rents are stable or rising. Core-plus/value-add opportunities of this type can be found in Stockholm, Copenhagen, Milan, Madrid, Barcelona, Oslo and Paris at yields between 5.25 percent and 6 percent, or higher for refurbishments and new developments. Yields may even exceed 6 percent for offices in secondary cities of the United Kingdom, the Netherlands, Sweden or Belgium.”