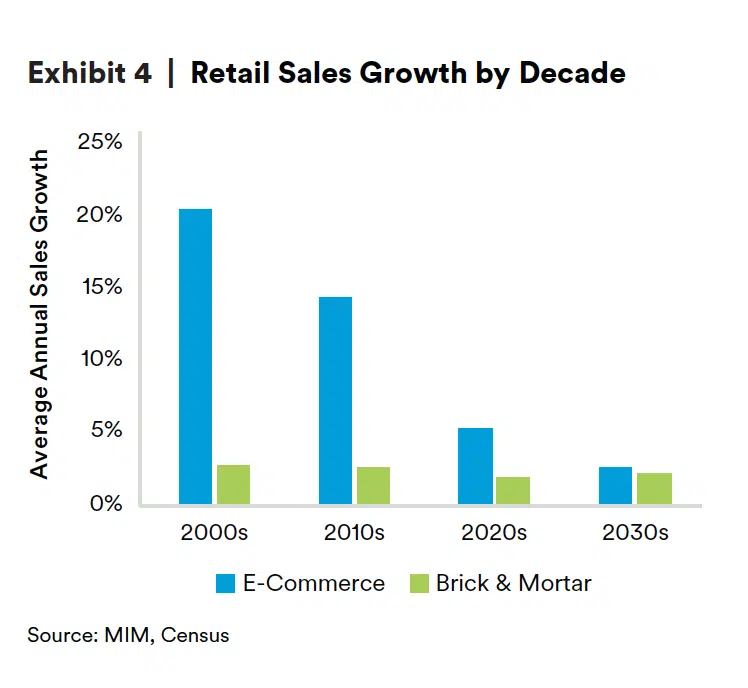

E-commerce growth to fall around the rate of brick & mortar retail sales growth in the 2030s

Investors may want to target retail centers with experience-focused tenants, such as restaurants, showrooms, event space and activities, according to MetLife Investment Management in its white paper, “A New Dawn in Retail.”

Goods-based retailers are increasingly using their stores as showrooms, to help boost their online sales. The result is less need for inventory, and less need for a large-format space. MetLife’s analysis of lease signings across more than 150 retailers suggests this trend is underway, with the median store footprint decreasing by 1.2 percent between 2017 and 2018. MetLife believes it will continue shrinking in the years to come, with continued focus being on centers with experience-based offerings, as well as centers with smaller spaces or with layouts that could be subdivided into smaller spaces in the future.

Grocery-anchored retail offerings are also downsizing, which has been driven by international grocers who have been able to leverage technology to operate with a smaller number of products that are customized for each store, based on the demographics and demand of the neighborhood.

E-commerce grocery deliveries have yet to affect the brick-and-mortar grocery markets. Today, online grocery ordering comprises only about 2.5 percent of market share, well below other retail product categories that average closer to 20 percent. But due to how quickly select online grocers have been growing in their test markets — as well as analysis of public filings from Amazon, trend growth in sales as reported by the Bureau of Economic Analysis, and consumer surveys — MetLife expects that online grocery ordering in the United States could grow from around 2.5 percent of market share today to at least 7 percent by 2023.

Markets such as Chicago, Baltimore and Salt Lake City meet these criteria, with around 53 percent of residents regularly buying goods online in 2018. Equally important is that the number of residents buying goods online exhibited little change over the last year, while the 50 largest U.S. markets rose from 44 percent to 49 percent. The retail real estate in these markets is less likely to be disrupted by e-commerce, or will at least be less disrupted than the rest of the country, in the 2020s.

The retail real estate in Los Angeles, Las Vegas and Oklahoma City is the most likely to be disrupted by e-commerce in coming years, according to the white paper.