LaSalle fund acquires 1.4msf mixed-use asset in Edmonton

LaSalle Investment Management has announced that its flagship core real estate fund in Canada, LaSalle Canada Property Fund (LCPF), together with Frankfurt-based fund-servicing company Universal-Investment on behalf of Bayerische Versorgungskammer (BVK), and two managing owners, North American Development Group and Canderel, have acquired Edmonton City Centre (ECC).

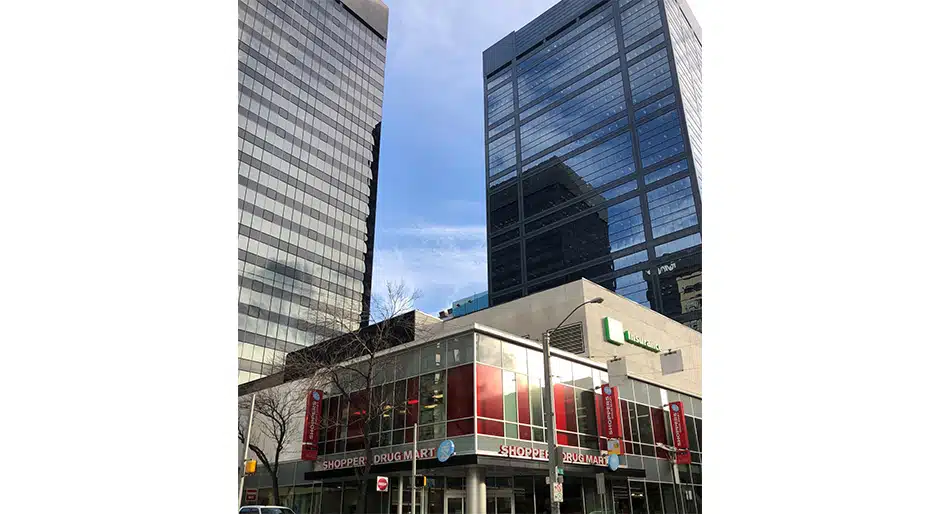

Collectively, the office component, including TD Tower, Oxford Tower and Centre Point Place, combined with retail leasable areas represent nearly 1.4 million square feet in a mixed-use asset, complemented by four parking components with a total of 2,500 stalls. North American Development Group entities, including CentreCorp Management, will provide property management services and leasing for the ECC retail component, and Canderel entities, including Humford Management, will provide property management services and leasing for the office and non-retail components. Mortgage origination sourcing and placement for the acquisition was provided by an entity related to Forgestone Capital.

“We are pleased to complete this transaction with our partners, as it represents a rare opportunity to own a landmark mixed-use asset with a strong tenant roster in the heart of Edmonton’s downtown core,” said John McKinlay, LaSalle Canada CEO. “This acquisition aligns well with LCPF’s objective to provide investors with immediate exposure to a diverse and mature portfolio of assets focused in Canada’s six major markets. We are pleased with the strong relative performance of the fund and the sustained interest from multinational investment partners.”

Michael Cornelissen, senior vice president of acquisitions for LaSalle Canada, added, “This transaction is emblematic of our ability to source world-class properties with industry-leading partners. We see tremendous potential in the ECC acquisition given the growth momentum of the adjacent Ice District, light rail transit connections that are supporting continued urban gentrification and population growth.”

Spanning three city blocks, ECC is situated at the epicenter of Edmonton’s financial core and is the major shopping center downtown, with an evolving service, convenience, entertainment, and food and beverage–focused offering. The retail and parking portions benefit from their Pedway connectivity and adjacency to the recent downtown Ice District development, Canada’s largest mixed-use sports and entertainment district with 180 events per year.

The Edmonton core has grown from a residential population of 10,000 in 2008 to approximately 15,000 in 2019, and is projected to have 18,000 residents by 2020. The dramatic increase in residential condominium and rental development has been driven by inbound urban migration, with 1,600 units recently completed, 1,400 residential units under construction, and an additional 3,100 units proposed in proximity to ECC.

Surrounding residential developments and recently completed office developments are driven by a strong urbanization trend in Edmonton. This trend will undoubtedly further increase the foot traffic coming to ECC beyond the traditional daytime office employee population.