To read this full article you need to be subscribed to Newsline.

Sign in Sign up for a FREE subscriptionGaw Capital Partners raises £28.5m to refinance London offices

Real estate private equity firm Gaw Capital Partners announced today that is has successfully raised £28.5 million (€31.7 million/$34.8 million) in mezzanine financing to refinance its preferred equity on its landmark office building in Docklands, London.

The lending consortium, led by Samsung Securities and KB Asset Management from Korea, provided the five-year mezzanine facility a loan-to-value ratio.

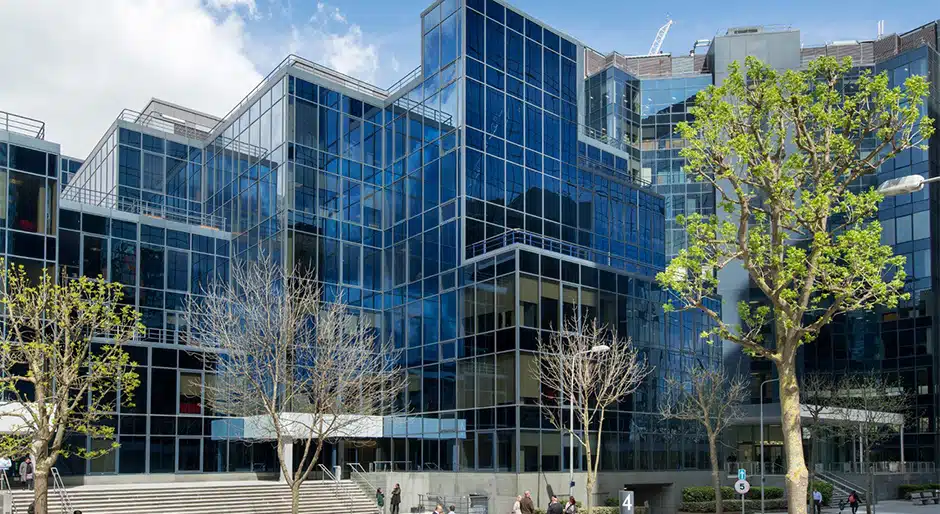

Acquired by Gaw Capital on behalf of Asian investors in September 2014, Harbour Exchange 1,2,4 and 5 comprises of 600,000 square feet of class A office space over four buildings between three and 16 floors, 500 car parking spaces and a nine-acre freehold. The property is well located in the Docklands area on the periphery of the Canary Wharf estate, benefiting from the communications links and amenities, while providing class A space at a significant discount to the Canary Wharf estate. This has attracted a diverse range of tenants from government, financial