Foreign investors spend $14.4b on U.S. industrial real estate

Foreign investors have made $14.4 billion worth of U.S. industrial real estate acquisitions in 2018, up 152 percent year over year due to several large entity-level deals and 29 percent above the average volume since 2015, according to CBRE Research and Real Capital Analytics.

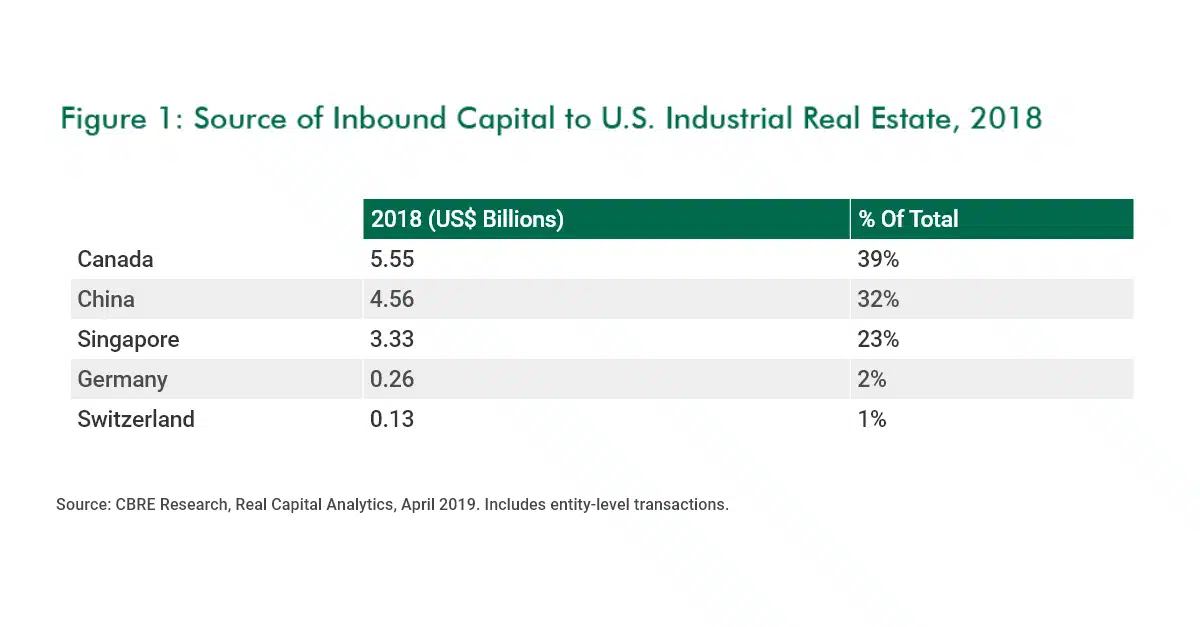

Foreign investors accounted for 21 percent of total U.S. industrial real estate investment volume in 2018. Investment from Canadian and Chinese buyers reached an all-time high, accounting for 70 percent of last year’s total foreign investment in U.S. industrial real estate.

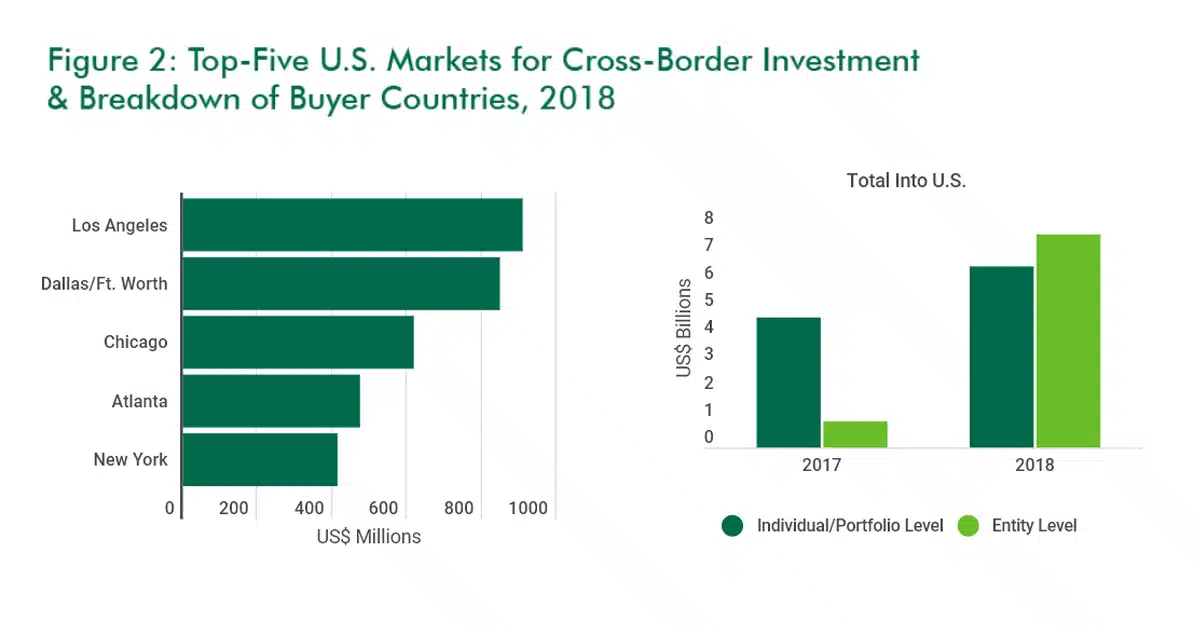

The top-three U.S. industrial markets for foreign investment were Los Angeles, Dallas/Ft. Worth and Chicago, with a combined $2.4 billion in 2018.

Separately, Los Angeles totaled $910.1 million in total sales price. More than half of the money spent in the city was from investors based in China; followed by Canadian investors (20 percent), and Germany-based investors (10 percent). The remaining equally came from Japan-based investors and Singapore-based investors.

Even when excluding large entity-level transactions (which vary greatly from year to year and can skew annual comparisons), the average annual volume of foreign investment in U.S. industrial real estate during the past five years rose by 68 percent, indicating strong demand for individual industrial properties and portfolios.