AXA IM – Real Assets enters JV to acquire U.S. logistics properties

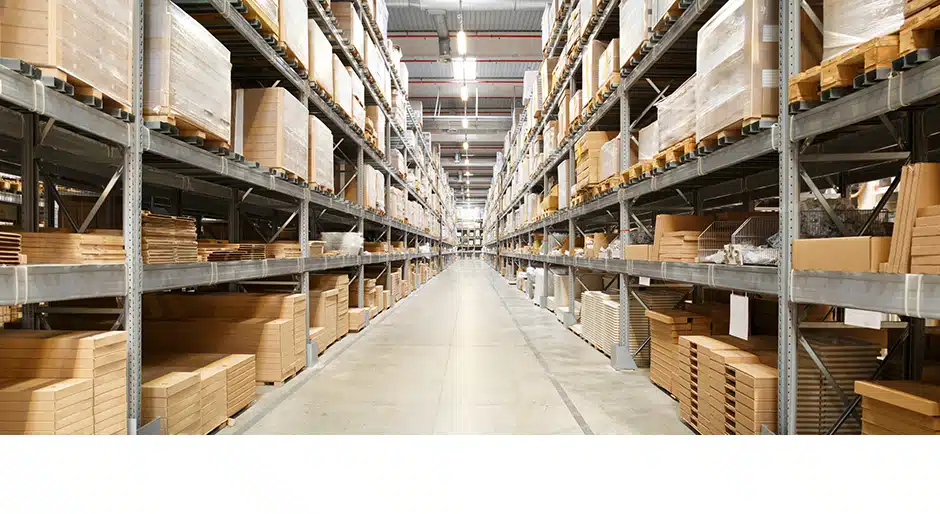

AXA Investment Managers - Real Assets and Bixby Land Co. have entered into a new joint venture to acquire up to $400 million of logistics properties in the Western United States.

AXA IM - Real Assets, investing on behalf of one of its clients, is the majority shareholder in the joint venture and Bixby will act, in an exclusive capacity, as property and asset manager, further advancing its growing third party institutional investment management business.

The joint venture will seek investments in the industrial asset class targeting core and core plus strategies. It will target properties located in California, Arizona, Nevada, Oregon and Washington, leveraging Bixby’s established acquisition pipeline and existing real estate operations platform.

“The asset class is supported by a number of strong fundamentals driven by structural changes in supply chains, e-commerce and consumer behaviour and, as such, aims to deliver durable and growing long-term income streams," said Steve McCarthy, head of North America at AXA IM - Real Assets.

U.S. e-commerce retail sales for the fourth quarter of 2017 totaled $119 billion, an increase of 3.2 percent compared with the third quarter, the Census Bureau reported on Feb. 16. Total retail sales for the fourth quarter of 2017 were estimated at $1,304.3 billion, an increase of 2.7 percent (±0.4 percent) from the third quarter of 2017.

And industrial land prices have risen by double-digits as developers scramble to build new warehouses and distribution centers in the e-commerce era, according to CBRE.

Spurred by an increase in leasing activity for warehouse space, U.S. industrial rents inched up further, reaching $5.50 per square foot, with a year-over-year growth of 5.4 percent, according to JLL. As top logistics markets continue to operate at a sub-3.0 percent vacancy rate, JLL expects continued competition for quality space and added pressure on rents through 2018.

New deliveries for 2017 was 232.7 million square feet. For the fourth quarter 2017 alone, roughly 68 million square feet delivered (30 percent of the annual total).

Atlanta and Dallas lead the net absorption for the United States.

Other recent investors in the U.S. logistics sector includes BRE Alpha Industrial Property Owner LLC, an affiliate of Blackstone Group, acquiring 27 logistics properties located in the Chicago area, Florida and New Jersey.